Installment payments – or buy now, pay later (BNPL) plans – have exploded in popularity the last few years. What’s not to love? Consumers get to buy what they want and pay over time with interest-free installments. But what consumers may not know is that those convenient payment options at checkout are actually new loans or that repayment plans every two weeks can become a burden.

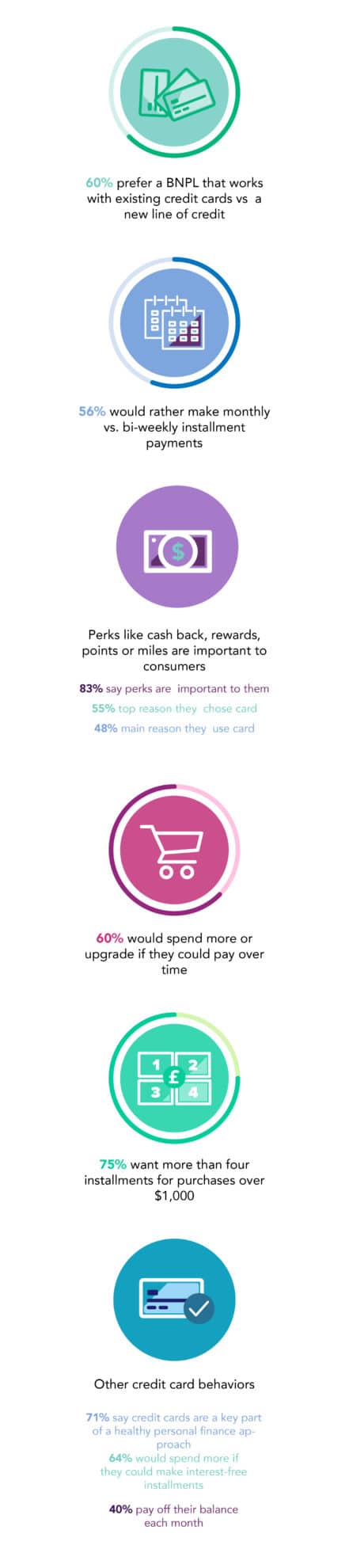

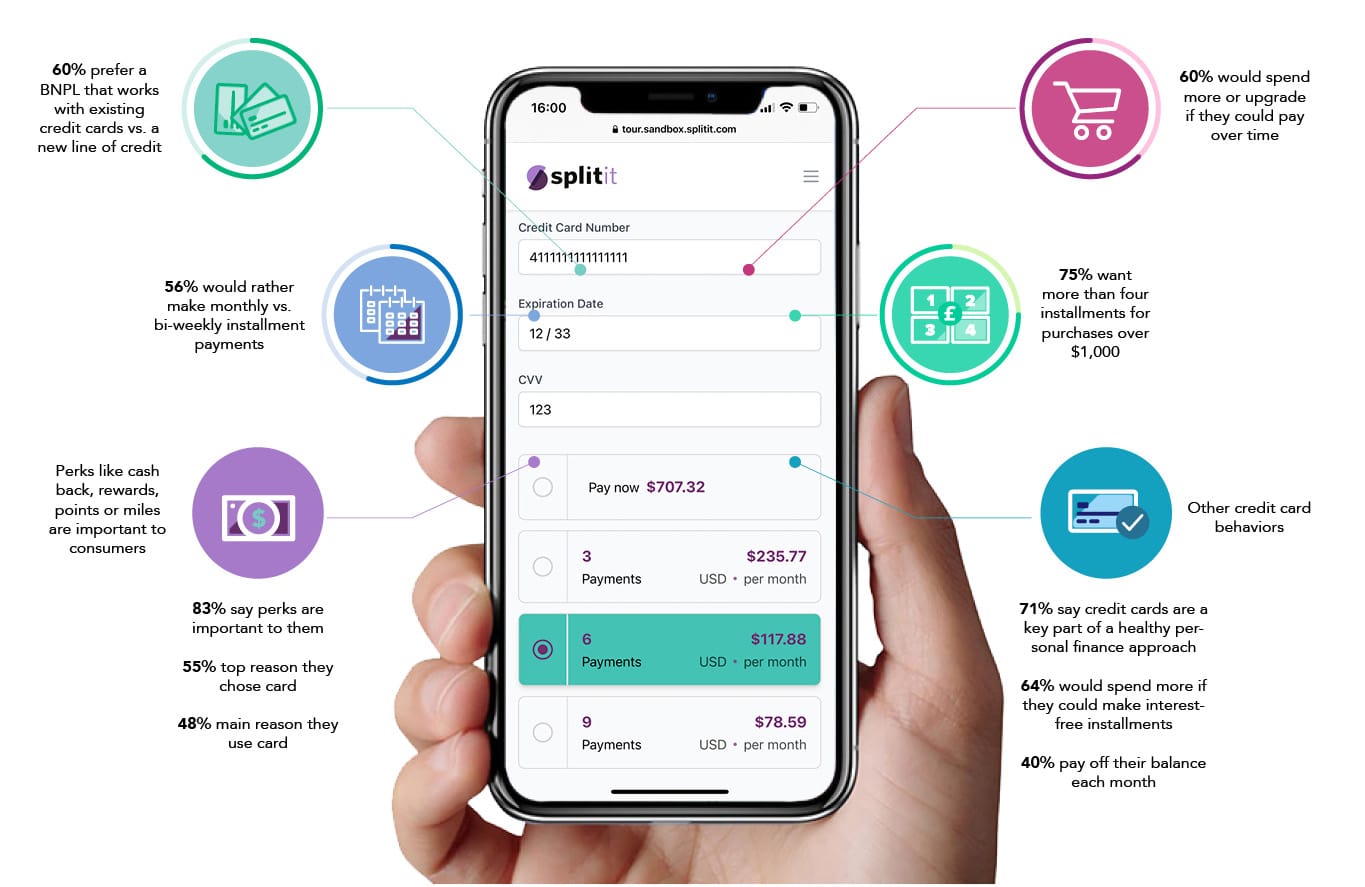

Splitit recently conducted a survey of 2,000 US consumers with credit cards to find out what their take is on BNPL and we have some surprising results. When it comes to new loans, 60% of consumers would prefer to use a BNPL option with existing credit cards versus opening new lines of credit. The survey also showed 56% prefer making monthly over bi-weekly payments and prefer longer terms, especially for larger purchases.

Why are merchants attracted to BNPL or installment payments? Consumers are likely to spend more, with 60% of consumers in our survey saying they would spend more or upgrade their purchase if they could pay over time.

But not all BNPL options are created equal. Splitit offers consumers a more responsible way to pay over time without adding new loans or impacting their credit reports. Any consumer with the available balance on their credit card is automatically pre-qualified to use Splitit. There’s no application, interest or hidden fees and no changes to their credit report.

A BNPL option linked to a credit card makes a lot of sense, according to the data. Our survey shows 83% of consumers feel credit card perks – like cash back, points or miles – are important and 48% say it’s the primary reason for using their credit cards. Because consumers who choose to pay in installments with Splitit are still using their credit cards, they continue to receive the same points or miles that they typically earn with that card.

On top of this, the survey discovered 71% see credit cards as part of a healthy approach to personal finances, 64% would likely use their cards if they could pay in smaller, interest-free installments and 40% say they pay off their balances each month.

Want to learn more about how Splitit can help you appeal to these consumers? Learn more about how you can get started today for free.