Retailers in the know are well aware of how Splitit helps their business not only remain relevant but grow in the midst of challenging circumstances. As the world begins to find its footing through a global pandemic, we delve into the three most important themes that should be at the forefront of every online retailers’ to-do lists – and how Splitit can make the difference between survival and growth.

If you haven’t yet explored buy-now-pay-later options for your online retail business or would like to offer your shoppers a more robust option, read on to discover how Splitit could make a huge difference to your digital sales.

Our main theme: Here’s how to keep up with (and pull ahead of) the crowd.

The COVID-19 pandemic has changed lives and upended routines in countless ways. In the e-commerce space, this change is best described as a massive acceleration of trends that had been gaining steam for the past few years. While specifically looking at how shoppers have responded to COVID-19, PFS Commerce found that in 2020, 63% of US shoppers purchased goods online that they hadn’t considered previously; this number rose to 75% for millennial shoppers. Online sales rose 24% from 2019 while in-store purchases fell by 7%.

To meet this surging demand, a November 2020 survey by Euromonitor International found that 72% of retail professionals said the pandemic sped up their digitalization plans by one to two years while 21% said it expedited their plans by at least three years.

Where does this leave small to mid-size e-commerce retailers? If you feel like you’re on a never-ending hamster wheel, you’re not alone.

Now is the time to pause, take a breath, and make sure the changes and “upgrades” that were put in place this past year are actually beneficial to your digital retail business.

Make Omnichannel Work for You

It may be tempting to plan for the end of the pandemic by daydreaming about a return to “normalcy.” Our advice: don’t take too long to turn your sights to the new frontier. Enhance and increase the profitability of your omni channel offerings. How? Take omnichannel one step further and make it “omni-personal” from the ground up.

Omnichannel means keeping the customer experience consistent and seamless at every point of contact – website, mobile storefront, social media, brick and mortar, click and collect, etc. The goal is to offer your shoppers a smooth and harmonious journey no matter how they find your brand, how they interact with your products, how they choose to make a purchase and how they receive their goods.

Omni-personal is harder to define as it’s different for each and every brand. This method of operation means that your shoppers drive brand strategy and business decisions. The goal of an omni-personal approach to your business model is to understand what your shoppers want and need at every level. If your shoppers are truly at the heart of your business decisions, your omnichannel structure will fall in line. Let’s discuss some concrete examples.

Shipping Costs vs. Delivery Speed & Quality

Your goal as a retailer is to lower shipping costs. Imagine how your bottom line would look with just a modest reduction to this budget item! There are a lot of ways to accomplish this. You could choose ground shipping rather than an air carrier. You could use cheaper packaging materials. Sure, you would lower costs in the short term but at the risk of massively damaging your business and reputation in the long term. Lengthy shipping times discourage shoppers from completing their checkout in the first place and a product that arrives damaged fuels dissatisfaction and really cuts into your bottom line with the cost of return shipping and the replacement product.

Shoppers want speedy, “free” delivery.

Source: Conveyco

In this case (like most cases), giving shoppers what they want makes good business sense. The quicker you can get your goods to consumers, the more satisfied they’ll be; the more likely they’re to shop from you again and just as good – tell their friends. Products that arrive in pristine condition and with a little bonus (perhaps a thank you note, or a sticker) make a great impression and provide another touchpoint for the shopper to have a positive interaction with your brand. Eliminating shipping wait times with automation (ex: to control inventory), keeping inventory close to potential customers (ex: warehouses in strategic locations, collaborating with a distribution partner), and reducing shipping damage (ex: use packaging made specifically for your product) serves both the shopper and your bottom line.

Eliminating Returns

Returns stink. They’re annoying for customers. And they really cut into the bottom line of small to mid-size e-commerce enterprises. At this point, free returns are a given if you want to be an online retailer. Let’s again put the customer first and see how investment to reduce returns isn’t only a boon to customers but also beneficial to your business.

Eliminating shipping damage is one way to limit returns. We mentioned tailored packaging in the section above. But shipping damage makes up a fraction of consumer returns. Shoppers need help selecting the right product in the first place. The screen of a mobile phone is a poor substitute for trying on a new pair of sneakers, discerning the texture of that spill-resistant sofa, or guessing how fluffy the “side sleeper” pillow really is. Here’s where you should lean heavily on technology to allow customers the maximum interaction with your products. If they truly understand what they’re purchasing, they’ll get what they expect when their box arrives in the post. If you meet or exceed your shoppers’ expectations, they won’t only keep the product but likely order from you again.

The way that a customer wants to interact with your specific product should guide the technology you implement to achieve this. Here are some stand-out examples:

- GlassesUSA provides a virtual glasses try-on where shoppers upload selfies so that they can see how different options work for their distinct face shape and tastes. Shoppers can adjust the image to get as close a fit as possible. They even offer a 100% money-back guarantee to reassure shoppers they can also try on every pair of glasses at home.

- SKIMS – this Kardashian-owned clothing company allows shoppers to view their products on differently sized/shaped models depending on the size of the garment. The technology here isn’t fancy but it works perfectly for the product: models + great digital photography + stellar website UI.

- SHOEFITTER is a tool for online retailers that uses the infrared scanning capability of mobile phones to create 3D models of shoppers’ feet and then suggest the shoe that will fit them the best. Why bother with bracketing when you can get the right size the first time! We love this example of using technology that most online shoppers already have to boost both their engagement and confidence.

Boutique vs. Mass Offerings

In the rush of consumer migration towards marketplaces (ex. Amazon) and to big box stores that act an awful lot like marketplaces (ex. Walmart, Target), it’s easy to despair and wonder how your business can compete. We’re here to tell you to take heart. Intimacy and personality still matter. Especially now.

We always return to the omni-personal approach. Ask yourself, “What do my shoppers really want?” The likely answer is that they want the unique offerings of a small to mid-size e-commerce business, with the convenience and ease of checkout pioneered by the 10-ton gorillas.

Hopefully, you already offer credit cards, PayPal and Google Pay. What about a buy-now-pay-later option? As a retailer, this is truly your chance to stand out. Buy-now-pay-later options aren’t created equal.

Splitit, allows shoppers to use an existing credit card to split payments into smaller pieces, payable over time. Splitit uses shoppers’ existing credit and puts it to work for them.

This is a great solution if shoppers already have the existing credit to buy the item(s), but the interest and fees make the purchase unmanageable or not worth it.

BNPL solutions, especially Splitit, are in a position to massively restructure the credit industry. They’re taking an omni-personal approach to put shoppers’ needs first. They realize interest and late fees are the primary reasons shoppers are unable to meet their financial obligations. Without these extra expenses, shoppers have more money to spend on the items they want to buy. Sure, consumers still have to honor their financial commitments, but they have time to do so, without the snowballing of interest and fees that occur with credit cards.

The Holidays Have Never Been More Important

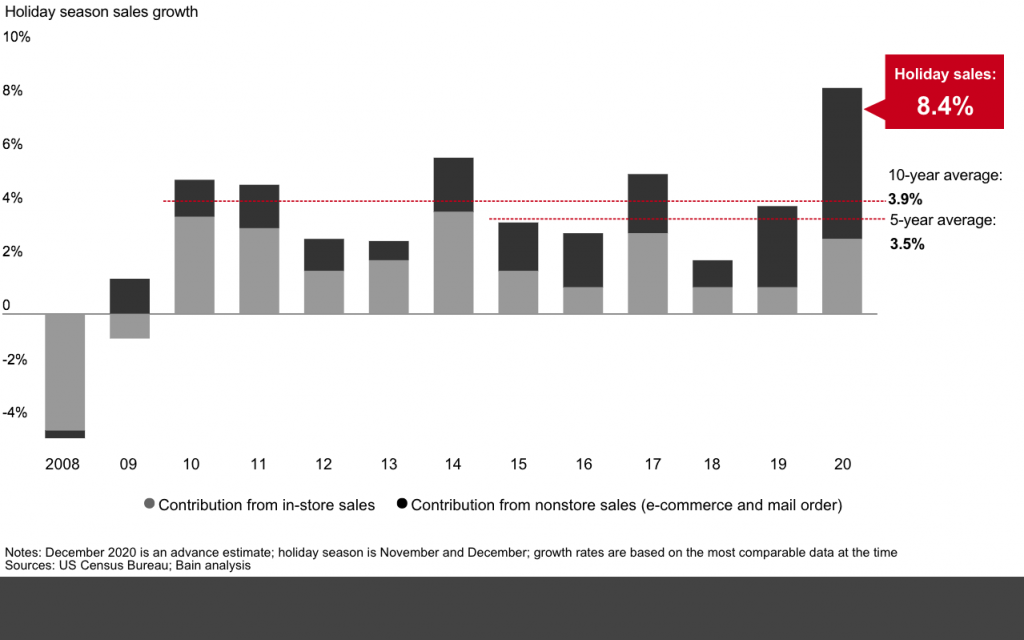

Why are we devoting time to a discussion of holiday sales, when the holiday season just ended? Online retailers know that if you’re not in the thick of it, you should be preparing for it. In fact, most larger retailers begin planning for holidays in January or February. But there’s more to it than that. Holiday sales grew 8.4% in 2020 as compared to 2019 – that’s significantly higher than the 10-year average of 3.9%. That’s great news for retailers, who should be in the midst of a 2020 holiday season post-mortem and already strategizing for 2021.

But what’s really eye-opening is the comparison between 2008 and 2020 holiday sales. In 2008, the global economy was in the throws of a financial crisis and recession. Holiday sales fell dramatically that year. During the 2020 holiday season, nine months into a global pandemic, holiday sales rose dramatically. What’s going on?

Source: Bain & Company

The COVID-19 pandemic is a crisis – but it hasn’t resulted in the same types of financial belt-tightening across the board that we witnessed in 2008. The change in spending patterns has been restricted to people who suffered a direct impact to their incomes.

While the pandemic is far from over, retail trends point to a change in the way consumers shop and what they’re shopping for, which is very different from the all-out spending halt of 2008.

The reality of shopping during the pandemic has changed shoppers’ expectations of when and how they complete a transaction and receive their purchases. “I’ll just quickly pop into a store and buy X” has morphed into “I’ll just buy X online, but will need to take shipping into account.” In 2020, online retailers did a banner job of educating shoppers to meet “guaranteed by Christmas” shipping deadlines. Mastercard tallies show that December 11 & 12 were the 3rd and 4th largest shopping days of the holiday season, even outperforming Cyber Monday.

Shoppers that were used to pursuing stores in person finally made the leap to digital – first-time buyers accounted for 59% of folks shopping retail categories on Black Friday and 56% on Cyber Monday.

Although this is an exciting time for online retail – there’s also a ton of uncertainty! How can retailers convince newcomers that digital transactions can and should become a normal part of their purchasing journeys? How can businesses calm shoppers’ anxiety at the most crucial moment, the fateful breath before they “PLACE ORDER” in the shopping cart? We’ve written at length about how to increase conversion rates, but by far the most straightforward way to ease shoppers’ uncertainty (during the holiday season and in general!) is to provide them with an alternative to the usual (and oftentimes predatory) payment options. Buy-now-pay-later solutions at checkout serve to quell purchase anxiety because they provide shoppers with a nuanced, thoughtful way to manage their budgets.

Most other BNPL financing options are essentially another line of credit. Shoppers will have an additional bill to pay, oftentimes debited directly from a bank account every two weeks. It might seem like a small amount, but that “disappearing” $50 or $100 every two weeks becomes another outflow that shoppers have to manage carefully, especially if those payments pull from a debit card and might cause an overdraft. It’s a tradeoff — consumers can buy an item they want or need now, but they add a new piece to their cash flow puzzle.

Splitit works differently. Because it puts a hold on an existing credit card, it doesn’t create a new bill for the shopper to pay. It also helps make sure consumers don’t go over their limits because the purchase amount has been held, which is extra important during the holiday season when shoppers are making many purchases within the same time frame. The hold decreases each time a monthly payment is charged. The only amount that shoppers will see on their credit card statements is the monthly installment payment, which helps spread out the total purchase over time, bypassing credit card interest and fees.

Be the Change You Want to See in the World

Retailers pay attention! Shoppers are paying attention to what your business practices look like, how you treat your employees, what your environmental impact is, and how inclusive your marketing and hiring really is.

A Valassis survey found that during the 2020 holiday season, 38% of US shoppers said they would intentionally shop at a business owned by a person of color or that promotes diversity.

Retail, as an industry, aims to sell products to all ethnicities, cultural backgrounds, genders, and ages. However, this diversity is rarely mimicked in the organizational structure of retail businesses themselves – from boardrooms to marketing departments. Common sense tells us that if you want to successfully market your products to a diverse customer base, your team should be diverse as well.

Diversity and inclusion within your business isn’t the same as inclusive marketing. The people who make up your team – that determines your diversity and inclusion. The way you portray your products – that’s (hopefully) inclusive marketing. The Hubspot definition of inclusive marketing is on the money:

When we consider what the peoples of the world really look like – it’s about time our marketing efforts reflect that reality.

Think with Google found that shoppers are more likely to consider, or even purchase, a product after seeing an ad they think is diverse or inclusive. After seeing such an ad, 64% said they took some sort of action (such as purchased or planned to purchase the product). This percentage increased for specific demographics: Latinx+ (85%), Black (79%), Asian/Pacific Islander (79%), LGBTQ (85%), millennial (77%), and teen (76%) consumers.

Where to start? Do your homework. Think about who your shoppers are or who they could be. Do your marketing materials reflect that? Spend time getting to know your shoppers – your campaign should be authentic and sensitive. Here are some examples of companies we think are getting it right:

- ThirdLove – This woman’s undergarment company created an ad campaign titled, “To Each Their Own” which was specifically created to represent women “in a way that felt grounded, relatable and universally understood.” Heidi Zak, ThirdLove’s co-founder and co-CEO, stated, “We want women to look at our campaign and see themselves in the women depicted.”

- Target – About a year ago, the internet lit up with a “real-life” image of a little boy in a wheelchair, looking up at an in-store ad of a little boy in a wheelchair. This is one of the best examples of inclusive marketing we know of because it normalizes disability.

Finally, think about your price points and if you can open up your market at all. Splitit can help level the economic playing field by allowing more shoppers to thoughtfully and responsibly make purchases without burdening their wallets or their credit.

As an example, a potential customer has an available credit card limit of $2,000 and would like to make a purchase for $1,500. If they can’t pay it off right away, they may prolong the payment schedule, which increases interest and fees, especially if they follow a minimum payment schedule.

With Splitit, if they choose six installments, they would incur a $1,500 hold, with monthly charges of $250, and are in a better position to pay in full each month. This ability can help encourage them to make a purchase that previously gave them pause.

Conclusion

Retailers are navigating uncharted territory as they race to keep up with rapidly changing consumer trends and shoppers’ demands. If you pay attention to the three key areas outlined above, and the ways that Splitit can make a difference, your business will be primed for success in the coming year.