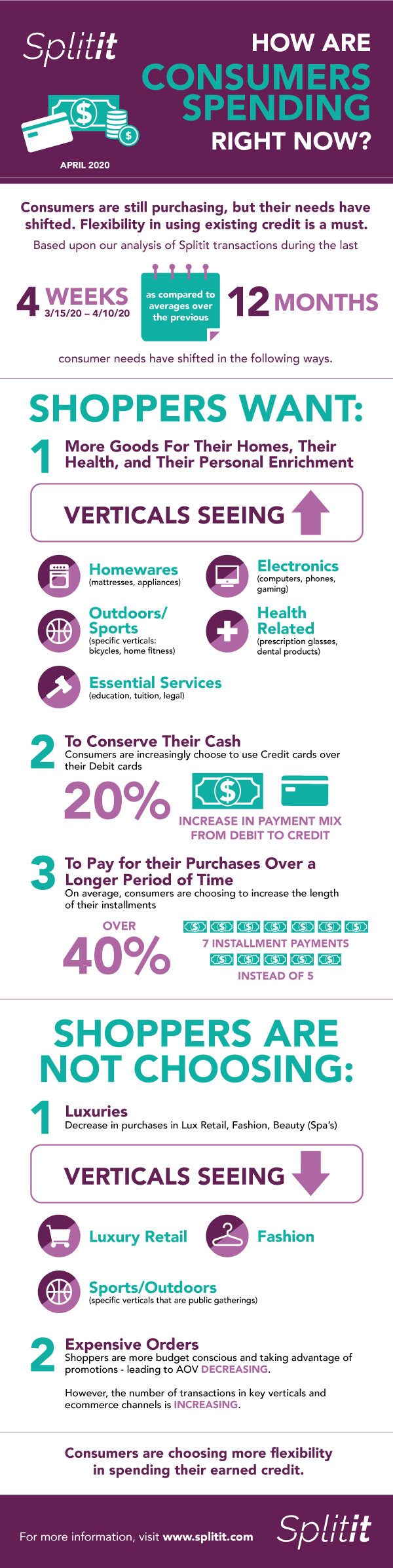

Splitit analyzed transaction data for purchases made through our platform over the past 12 months. Then we compared those same metrics to data from the past four weeks (March 15, 2020 through April 10, 2020) during which the economic uncertainty of the COVID-19 crisis really took hold.

The data provides a valuable snapshot of how spending and payment trends have changed as a result of the coronavirus pandemic.

In short, we found that shoppers are still spending but their needs have shifted.

Here’s what we have learned in more detail.

What Shoppers Want – and What They Are Postponing

As over 90% of Americans are now under stay-at-home or social distancing orders, shoppers are leaning towards more goods for their homes, their health, and their personal enrichment. They are leaning away from categories that are more traditionally used out of home, in social situations, or in entertainment contexts.

Homewares

Many people have shifted to a work from home situation and need to create or upgrade their home office space. This trend will likely continue as 56% of people in the US have jobs that can be done at home. However, with the current economic uncertainty, these shoppers are likely to be careful with budgets.

A McKinsey & Company article notes that on the whole shoppers are reducing their discretionary spending dramatically and 75% of people expect this current financial situation to last more than 2 months.

SplitIt is an immensely valuable option for retailers to offer at checkout because it can lower the perceived price of an item as well as give shoppers a longer window during which to pay for their desired items by paying in installments with no additional costs or burdens.

Online mattress sales have shown resilience, too, as many mattress showrooms are now closed. Often, a new mattress can be a difficult purchase to delay if the shopper truly needs a more comfortable and restful night’s sleep.

Rather than delaying the purchase of a mattress, Splitit can help make these higher ticket items more immediately affordable without retailers having to offer deep discounts but instead by offering a higher number of installments, as we discuss below.

Finally, people who haven’t seen as much financial impact from the crisis are starting to do home projects that they delayed (redecorating, organizing, etc.) since they are now spending significantly more time at home. Installments are a vital tool for helping both budget conscious shoppers manage their finances and retailers increase their share of the wallet.

Outdoors / Sports

Shoppers are looking for safe options for exercise and solitary outdoor recreation. At present, nearly all states have some form of stay-at-home orders, which include a mandate that gyms close. Many fitness chains have responded by shutting their doors nationwide.

Beyond that, even before the current situation, home gyms were experiencing a renaissance and many of the in-home solutions come with higher price tags. These are more important than ever now that team sport activities are heavily restricted.

Despite the cost, people are setting up their homes to fulfill their workout needs.

Offering installments via Splitit can help shoppers make the decision to purchase a large piece of equipment, add additional accessories, and upgrade weightlifting sets and other personal exercise equipment.

Education

Online learning is having a moment. Or two. Almost everyone is talking about how professionals can use this time to add new skills, certifications, credentials, and other resume builders. Busy parents also need high-quality content to help homeschool children right now. While many of the big platforms like Coursera and Udemy are offering free content, shoppers are still looking for top-quality learning.

Splitit gives people an affordable way to spread out payments for paid courses and programs that will contribute to their longer-term personal or professional development.

Electronics

The shift to stay-at-home has necessitated the purchase of computers, tablets, and accessories in order to keep up with the demand for virtual connection. Workers need both hardware and software in order to do their jobs. Parents and schools are purchasing tablets for their students. Add gaming and at-home entertainment to the mix, and the electronics industry is full of possibility.

Splitit allows shoppers to afford these often high-budget purchases with the option to pay over time and helps increase Average Order Value by making the addition of accessories more palatable and budget-friendly.

Health

Essentials haven’t changed. However, the ways in which shoppers pay for them have. People still need prescription glasses and dental products and they are increasingly purchasing these items using installment options. Budget-conscious shoppers are concerned with cash on hand. Splitit gives shoppers more power over managing a tight budget with the ability to spread payments out in bite sized pieces.

Luxury Retail, Fashion, Higher-Ticket Orders

Data from the past four weeks have revealed that shoppers are more budget-conscious and are tending to take advantage of online promotions. This potentially leads to decreasing Average Order Values (AOV). One way to respond to this trend is to offer the Splitit payment option to shoppers, so they feel comfortable making larger purchases in the face of economic uncertainty.

Despite the decline in AOV, the number of ecommerce transactions is actually increasing. Shoppers are still spending. It is up to retailers to adapt to their new needs. The SplitIt option at checkout gives shoppers greater flexibility and provides more opportunities for them to purchase higher price orders at checkout.

How Consumers Are Adapting

Conserving Cash

Shoppers are increasingly choosing to use credit cards over debit cards – 20% more transactions were completed with credit cards over the past four weeks compared to the past 12 months.

Shoppers are concerned with cash on hand and want to be able to manage their cash flows in a responsible manner. Small business and development centers across the U.S. are not mincing words when giving advice – Pay your bills slowly. The SplitIt installment option with its approach to responsible use of existing credit provides peace of mind to shoppers in these uncertain times, without tapping into their immediate cash on hand.

Time to Pay

On average, shoppers are choosing to pay for their purchases over a longer period of time. We see this in the trend to increase the length of their installments when paying via Splitit as well.

Over 40% of shoppers have moved from a five-payment-plan option (the most typical length of a plan prior to the current situation) to a seven-payment-plan option. Because Splitit charges no additional interest or installment fees as part of a plan, retailers offering this option may very well see greater uptake of this solution, and as a result, a bit more insulation against these challenging times for the retail sector.

How Businesses Are Adapting

Shopper needs drive the market. Retailers scramble to adapt. Online retailers face unique challenges and this time of global crisis serves to make shopper patterns that much more uncertain. However, from our most recent research as well as our frequent shoppers surveys and analyses, we do know that shoppers want more flexibility in spending their earned credit.

SplitIt’s Buy Now, Pay Later solution is win-win for both shoppers and retailers. It provides greater flexibility and peace of mind to shoppers, while its streamlined UI leads to a quicker checkout and has been proven to increase conversion rates and AOV.

With a quick and seamless implementation process, it is not too late for your business to adapt. Contact us for a demo and to see how we can help you adapt to today’s retail challenges.