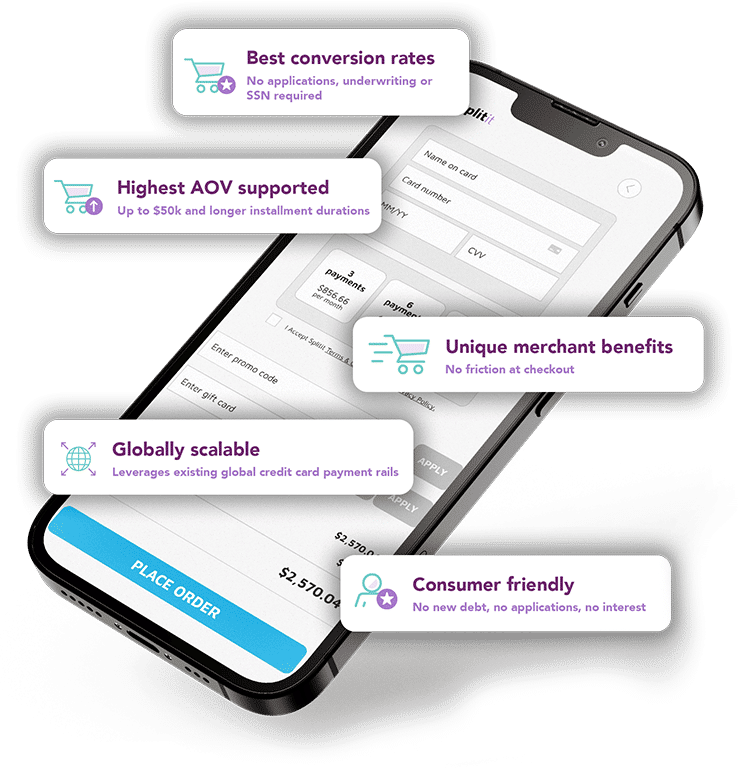

Omnichannel & global capabilities

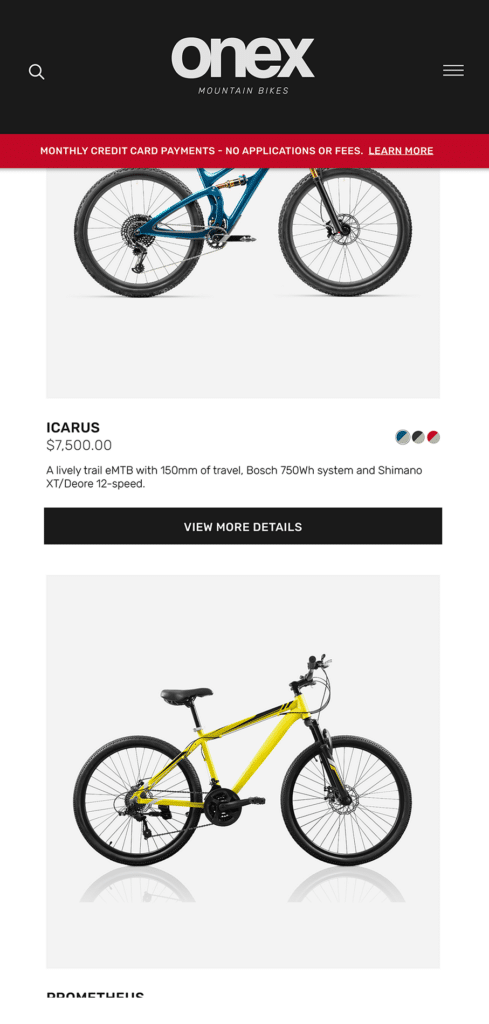

A single global API makes Splitit’s Installment-as-a-Service the easiest pay-later option to adopt, integrate and operate across all consumer touch points.

Your data is your data

Unlike legacy ‘Buy now, pay later’ providers, we don’t acquire your customers, harvest their data, or cross-sell to them. Your shoppers remain your shoppers.

Frictionless payments

Own the end-to-end journey

Our installment payment solution puts your brand at the centre, allowing you to keep control of your customer journey and increasing your brand loyalty.

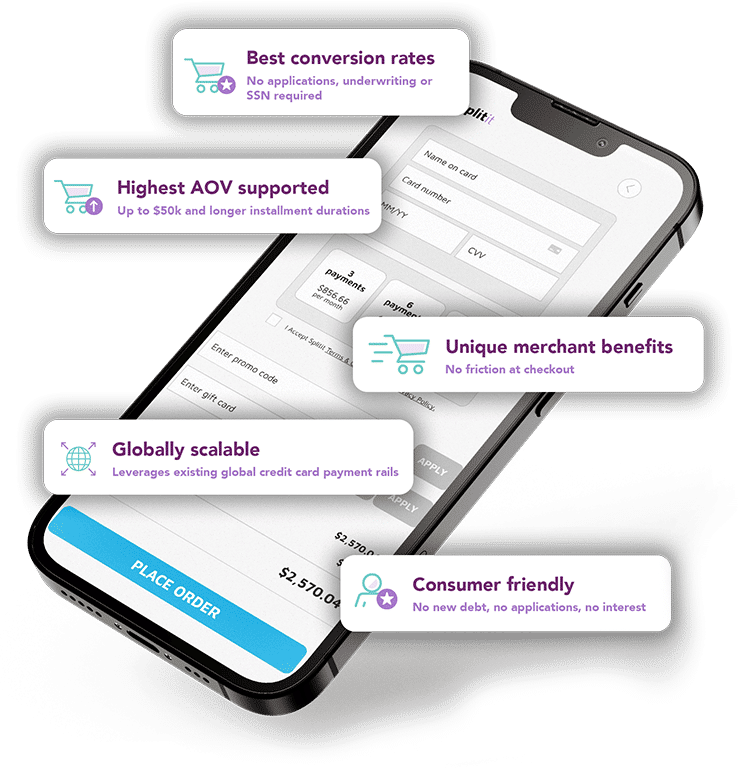

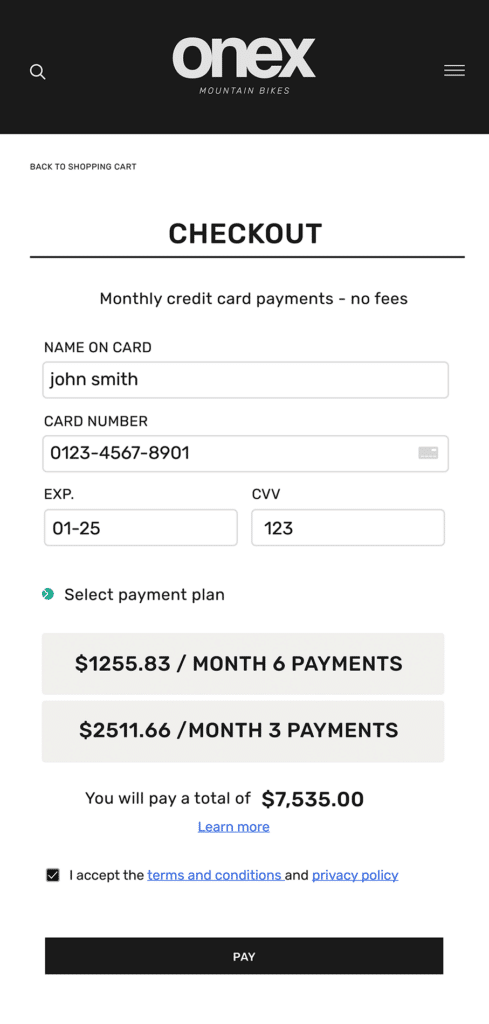

No registrations or redirects

Splitit embeds in the current purchase flow allowing any consumer with an active credit card to use the service – there’s no third-party registration or application needed.

Use existing credit

Splitit removes the high risks of legacy BNPL by using existing credit, meaning there is no underwriting and we won’t hurt your shopper’s credit rating.

Number of installments

Select different payment plan lengths based on price ranges (up to 3 per range)

Payment frequency

Offer your customers to pay in monthly or biweekly payments

Create your own messaging

All elements can be configured to your specifications – change the colors, copy, font sizes and more.

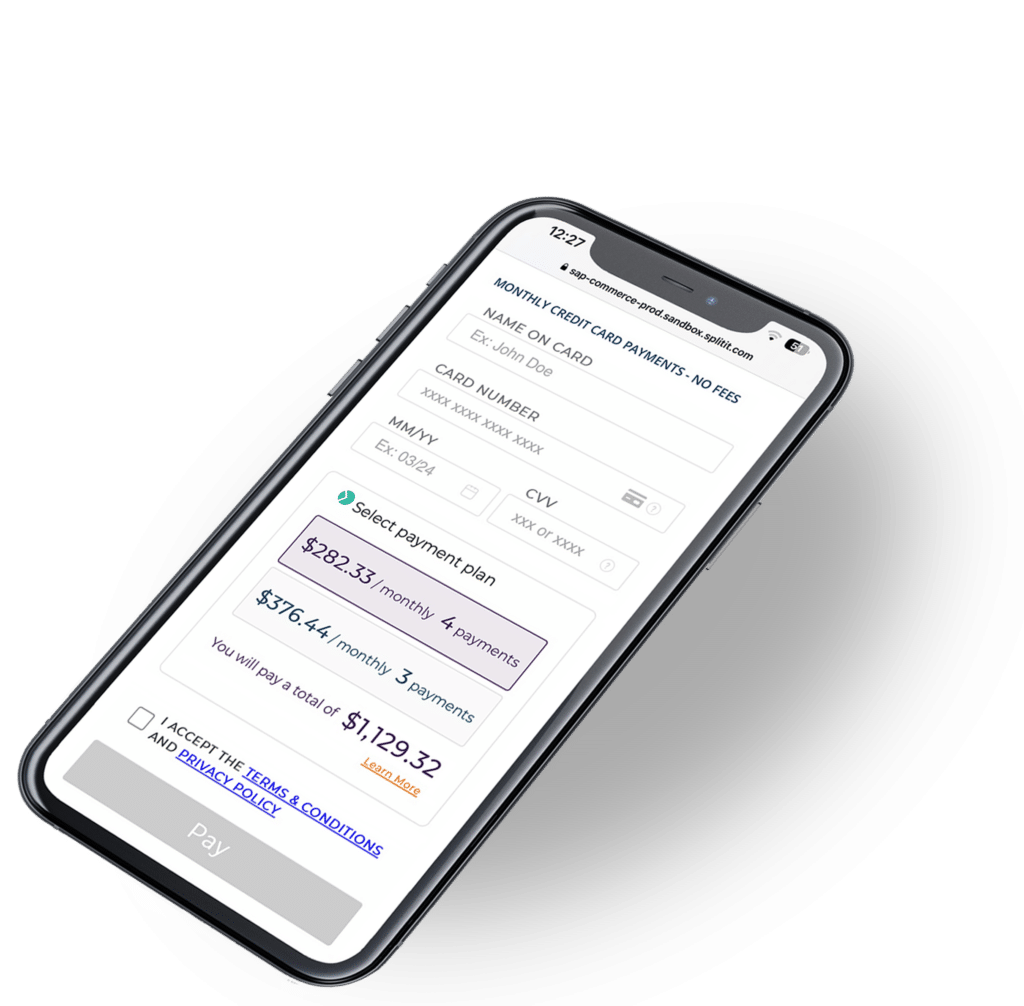

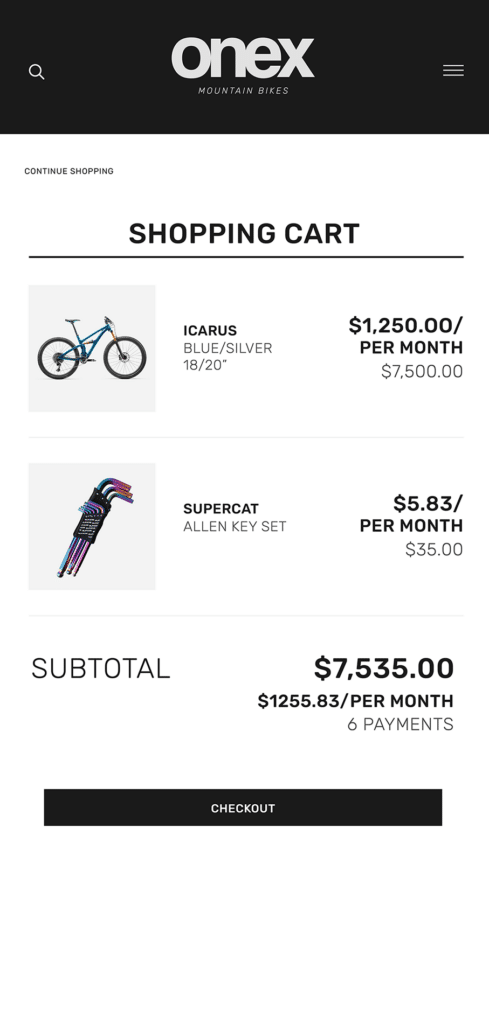

Installment plan

Shoppers can choose to split their payments over 2-12 monthly installments all within your payment journey.

Authorization

Splitit authorizes the full amount of the purchase and places a temporary hold on the shopper’s credit card.

First installment

The first installment is charged a few seconds after the purchase authorization or upon shipping.

Pay monthly

Splitit will charge the shopper’s credit card every month until the plan is finished.

Explore all features

| Standard | Funded | |

|---|---|---|

| Guaranteed full transaction amount* | ||

| Min. annual sales volume | $30,000,000 | $30,000,000 |

| Max. order value | $20,000** | $20,000** |

| Installment frequency | Monthly Biweekly | Monthly Biweekly |

| Number of installments | 2-12 | 2-9 |

| Receive payments | Monthly (inline with customer plan) | Upfront (at the time of transaction) |

| Supported gateways | BlueSnap Fidelity (CardKnox) Adyen Authorize.net Ingenico (Ogone) WorldPay Paysafe SagePay Moneris EVO eWAY …and others | BlueSnap Fidelity (CardKnox) Adyen Authorize.net Ingenico (Ogone) WorldPay Paysafe SagePay Moneris EVO eWAY …and others |

| Supported countries† | Andorra, Australia, Austria, Belgium, Canada, Cayman Islands, Denmark, Faroe Islands, Finland, France, Germany, Gibraltar, Greece, Guernsey***, Hong Kong, Iceland, Ireland, Isle of Man***, Israel***, Italy, Jersey***, Liechtenstein, Luxembourg, Malaysia, Malta, Mexico, Monaco, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, UK, US | Australia Canada UK US |

**Limit of $20,000 is set by default. Please contact us for other options.

***Some restrictions apply

†Anyone with a credit card can use Splitit in any country, but your business must be registered in a supported country.

Share a few details and we’ll get in touch

Share a few details and we’ll get in touch