Apply

Contact our sales team to start your Splitit application. You will need to have your payment gateway already setup and a minimum of $30m in annual sales.

Install

Splitit currently offers plugins for Shopify, Magento, WooCommerce, Salesforce Commerce Cloud, BigCommerce, Wix and SAP Commerce Cloud.

Add to your site

Get your e-commerce website updated with our fully customizable on-site messages to help you drive conversion.

Standard

Get paid with each installment

When a shopper places an order using Splitit, you will receive a payment every month until the full amount is paid.

Funded

Get paid upfront

With Splitit’s funded model, you get paid the full amount when a shopper places an order. You can apply for our funded model after you have completed your registration.

Qualification requirements: Minimum of one year in business; Registered in US, UK, Canada or Australia; $30,000,000 processing volume in annual sales.

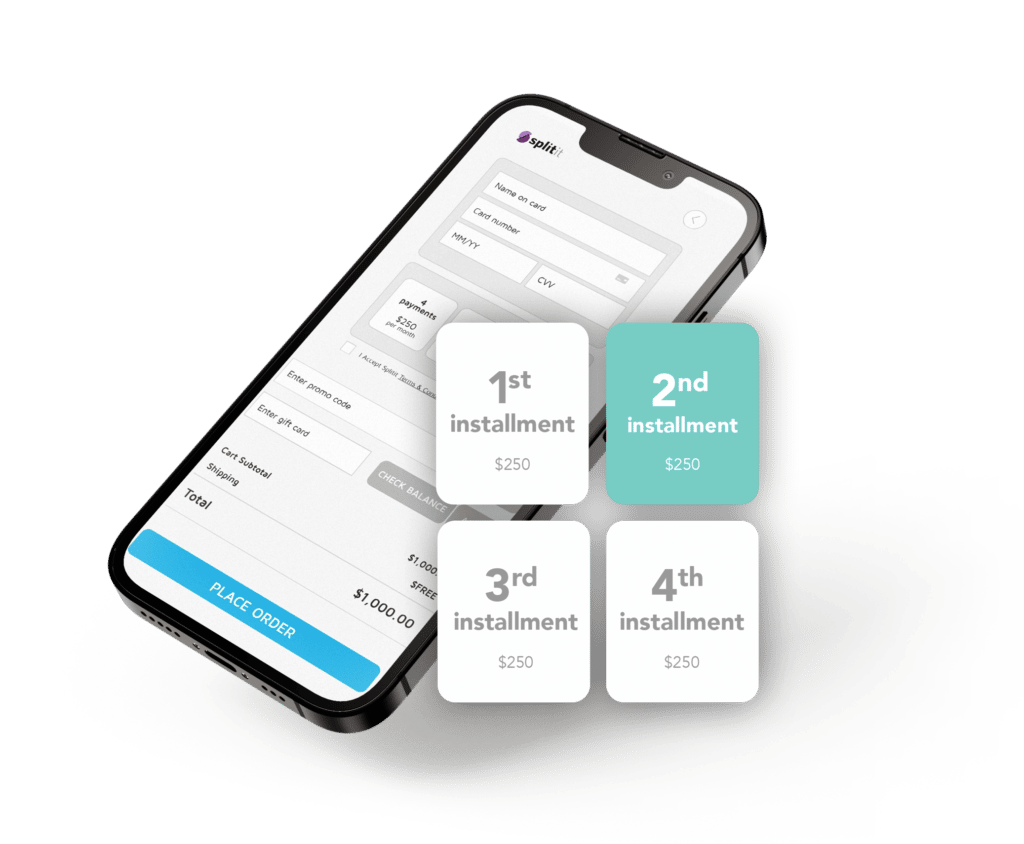

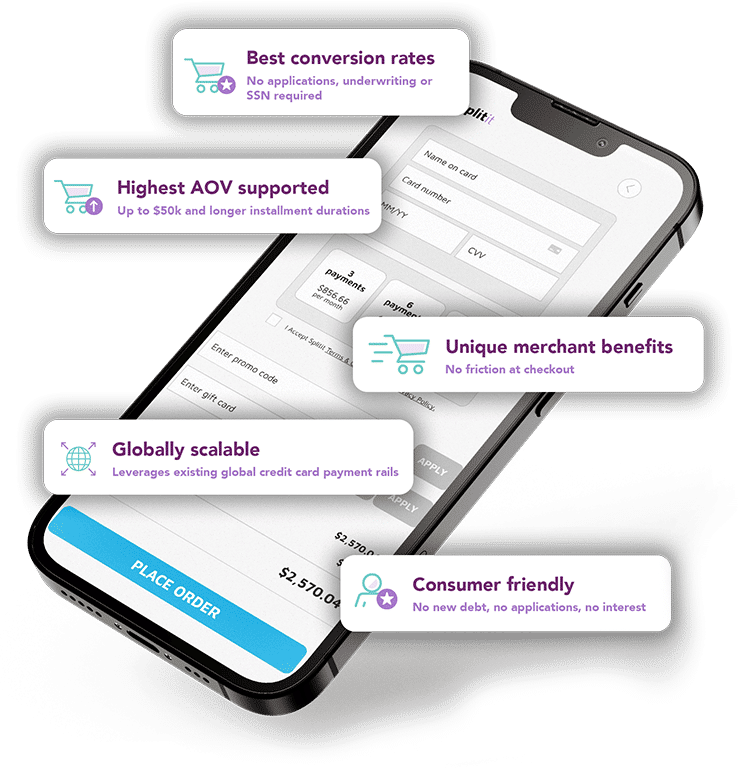

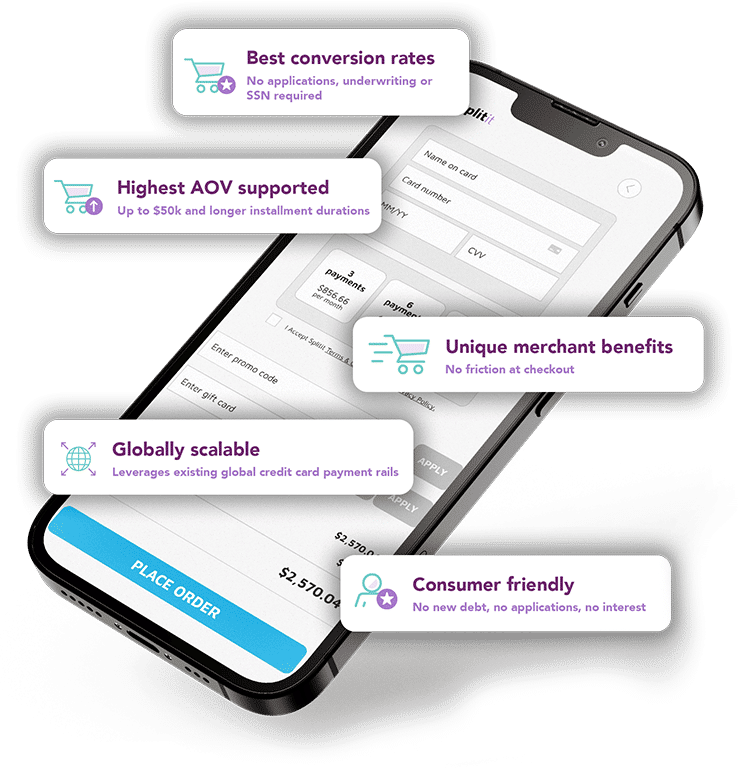

Installment plan

Splitit authorizes the full amount of the purchase on the shopper’s existing credit card and reserves the balance from their credit card until final payment is made. Shoppers can choose to split their payments all within your payment journey.

First installment

The first installment is charged a few seconds after the purchase authorization or upon shipping.

Reauthorization

Splitit reauthorizes the outstanding amount when the previous authorization is about to expire.

Pay monthly

Splitit will charge the shopper’s credit card every month until the plan is finished, reducing the hold on their credit line each month by the payment amount.

Explore all features and requirements

| Standard | Funded | |

|---|---|---|

| Guaranteed full transaction amount* | ||

| Min. annual sales volume | $30,000,000 | $30,000,000 |

| Max. order value | $10,000** | $10,000** |

| Installment frequency | Monthly | Monthly |

| Number of installments | 2-12 | 2-9 |

| Receive payments | Monthly (inline with customer plan) | Upfront (at the time of transaction) |

| Supported platforms | Shopify Magento WooCommerce Salesforce CC Wix BigCommerce SAP Commerce Cloud | Shopify Magento WooCommerce Salesforce CC Wix BigCommerce SAP Commerce Cloud |

| Supported gateways | BlueSnap Fidelity (CardKnox) Adyen Authorize.net Ingenico (Ogone) WorldPay Paysafe SagePay Moneris EVO eWAY Bambora (US & Canada only) …and others | BlueSnap Fidelity (CardKnox) Adyen Authorize.net Ingenico (Ogone) WorldPay Paysafe SagePay Moneris EVO eWAY Bambora (US & Canada only) …and others |

| Supported countries† | Andorra, Australia, Austria, Belgium, Canada, Cayman Islands, Denmark, Faroe Islands, Finland, France, Germany, Gibraltar, Greece, Guernsey***, Hong Kong, Iceland, Ireland, Isle of Man***, Israel***, Italy, Jersey***, Liechtenstein, Luxembourg, Malaysia, Malta, Mexico, Monaco, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, UK, US | Australia Canada UK US |

**Limit of $10,000 is set by default. Please contact us for other options.

***Some restrictions apply

†Anyone with a credit card can use Splitit in any country, but your business must be registered in a supported country.

Share a few details and we’ll get in touch

Share a few details and we’ll get in touch

Frequently asked questions

Any shopper with a MasterCard credit card, VISA credit card or Discovery credit card can use Splitit, no matter which country they live in.

If you would like to add Splitit to your Ecommerce site, your business needs to be registered in one of these countries.

Yes, it is mandatory for you to be VAT/TAX registered in order to use Splitit.

Splitit is supported by Visa, Mastercard, and depending on the merchant, American Express, Discover and UnionPay.

Splitit takes liability on secured credit card transactions, with some exceptions. However, we do not take liability on chargebacks, fraud, or gateway errors coming from the merchant’s side.

For more information, please refer to our terms and conditions.

You can find information on which Ecommerce platforms we work with here, along with how to add Splitit to your site.

All transactions are paid to the merchant within 3 business days.

There are certain requirements that a business needs to fulfil in order to become funded:

a) Your business must be registered in the United States, Canada, UK or Australia.

b) Your company needs to have been in business for more than 1 year.

c) Your business needs to achieve an annual revenue of $10 million or more.

Before you can apply for funding, you first need to set up your business account and complete the onboarding process. Once this is done, you can apply for funding. Applicants must go through KYC and an underwriting process in order to be approved.