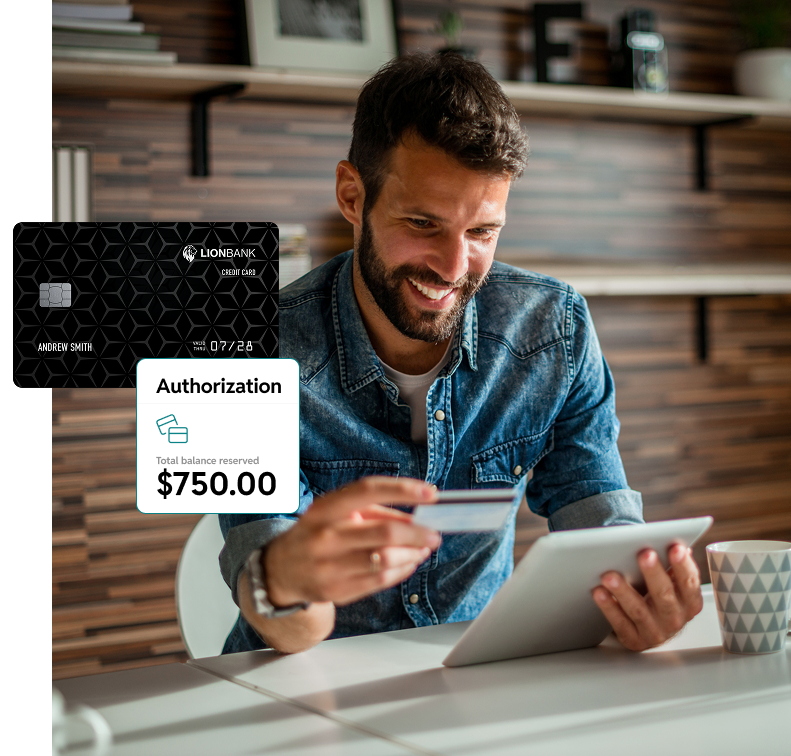

Flexible payments made simple

Use your existing credit card. No lengthy applications needed.

Still have questions about how Splitit works?

Review our most commonly asked questions here, or visit our Support center for more resources and the ability to live chat with us.

Retail Plan: In this option, Splitit enables the merchant to offer you the ability to pay in installments using your existing credit card with no added fees. Your credit card issuer’s terms and fees still apply.

Splitit Financing: In this case, Splitit provides the installment plan directly to you via the merchant’s checkout. Finance charges apply and are clearly shown to you before you confirm. The terms and rates are outlined in the agreements you have received.

To check which type of plan you are on, please log in to your shopper portal.

You can start a live chat with us, or visit our support center.

No, unfortunately not. We are only able to accept credit cards at the present time.

The supported credit cards vary depending on the merchant and plan selected. The supported cards will be clearly marked at the merchant checkout. We typically accept Visa, Mastercard, and depending on the merchant, American Express, Discover and UnionPay.

Retail Plans are available in most parts of the world, depending on the merchant’s locations.

Splitit Financing is only available in the United States, excluding the states of Alabama, Alaska, Arkansas, California, Connecticut, Delaware, Florida, Hawaii, Indiana, Kentucky, Massachusetts, Minnesota, Mississippi, Nebraska, Nevada, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Dakota, Texas, Vermont, Virginia, and Washington. Please see Splitit.com/legals/licensing/ for license and disclosure information.

You can find all our terms and conditions here.

Yes. Splitit helps consumers use their existing credit card to turn purchases into smaller, flexible payments.

The full amount of your purchase, plus finance charges (for Splitit Financing Plans) will be charged on the selected plan duration.

Payments are the regular monthly or bi-weekly charges toward your purchase.

Authorizations are temporary verifications for the remaining balance, ensuring your plan can continue without interruption. You’ll only be charged for your installment amount on each payment date. Please note an authorization is not an actual charge.

Authorizations are temporary, but the exact timing is set by your bank or credit card issuers. Since this is determined by your bank, they can give you the most accurate timeframe, however they are typically seen on the account for 3- 25 days.

For Retail Plans there are no additional fees or interests. Your credit card issuer’s terms and fees apply.

For Splitit Financing a finance charge will apply and will vary based on your state of residence. However, Splitit does not charge any late fees, prepayment penalties, or other associated fees.

No. No new credit checks are required to use either a Retail Plan or Splitit Financing. Splitit does not report to the credit bureaus.

Live chat

Instant answers to your support questions

Or email us and we aim to reply within 24 hours.