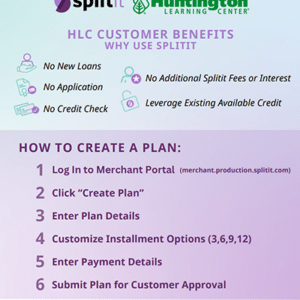

Drive more conversions

With no registrations, a fast checkout and high approval rates, Splitit on average drives 30% more conversions.

Retain your customers

At Splitit, we don’t acquire your customers, harvest their data, or cross-sell to them.

More responsible

Splitit unlocks $3T of existing underwritten credit, so there’s no need for consumers to take out a new loan.

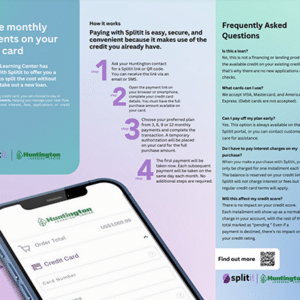

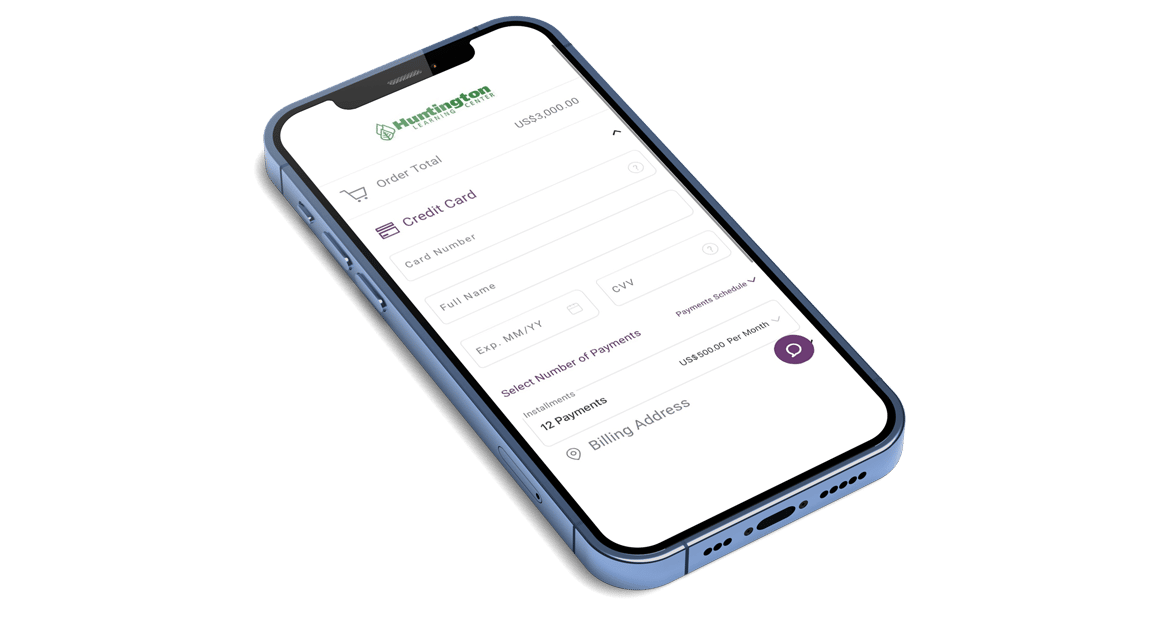

Installment plan

Shoppers can choose to split their payments in 3, 6, 9 or 12 monthly installments all within your payment journey.

Authorization

Splitit authorizes the full amount of the purchase on the shopper’s existing credit card and reserves the balance from their credit card.

First installment

The first installment is charged a few seconds after the purchase authorization or upon shipping.

Pay monthly

Splitit will charge the shopper’s credit card every month until the plan is finished.

I think 80% of our Splitit transactions are families that we probably would have not enrolled had Splitit not been there.

Maria Aruca – Regional Director, Huntington Learning Center

Pricing

Splitit provides you with the option to offer your customers 3, 6, 9 or 12 monthly payment plans. Huntington Learning Centers are on a funded plan, so that means you will receive the funds upfront when your customer makes a purchase.

| Charge | |

|---|---|

| 3 month plans | 5.63% |

| 6 month plans | 6.94% |

| 9 month plans | 8.50% |

| 12 month plans |

Register your business

Register your interest today and someone will be in touch to get you started.

Frequently asked questions

Applicants must go through KYC and an underwriting process in order to be approved.

After you have completed your online registration, we will contact you to ask for additional documents. We normally require:

- CPA-compiled financial statements (Balance Sheet and Profit and Loss statement) or a complete U.S. Corporation Income Tax Return for the most recent fiscal year.

- Internally prepared year-to-date financial statements (Balance Sheet and Profit and Loss statement).

- Complete monthly statements/invoices from your current merchant account provider or payment gateway (must show chargebacks and refunds) for the past 3 months.

- Full names, dates of birth, home addresses, and photo IDs for all beneficial owners with 25% or more ownership in the company.

If the shopper has already confirmed the plan and you need to cancel the sale, a full refund process is required. In this scenario, our system will adjust the fees based on the number of days the plan was funded and the outstanding amount owed to Splitit.

If the card expires or is canceled, the customer has a 7 day grace period to update their information in their portal. If it isn’t resolved within the 7 days then the remaining amount owed (pre-authorization remaining) is then charged.

Splitit eliminates the credit risk for the merchant. We guarantee the full amount of the purchase so there is no risk that the merchant will not receive the payment.

All transactions are paid to the merchant within 3 business days.