Simple monthly payments

Use your existing credit card.

No new loans or applications needed.

No additional interest or fees*

Splitit will never charge you interest or fees. (Your standard credit cards T&Cs still apply)

No new loans

Use the credit you have already earned. All you need is the balance available on your credit card.

Keep the rewards coming

You get all the benefits of paying with your credit card, including rewards, transaction insurance and protection against fraud.

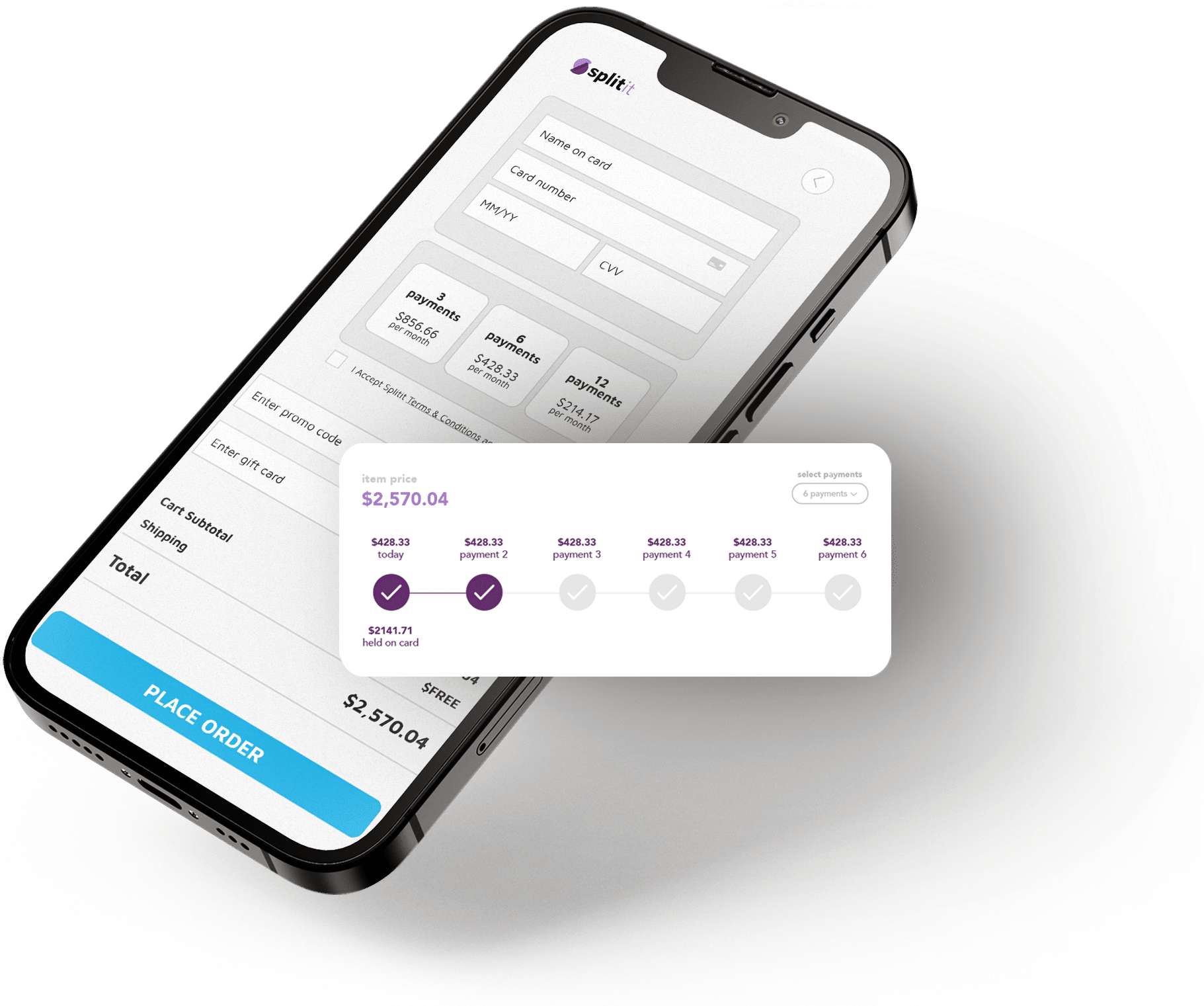

Installment plan

You choose the number of monthly payments that suit you and your budget. You will need the full purchase amount available as credit on your credit card on the day of purchase.

Authorization

Splitit authorizes the full amount of the purchase on your existing credit card and reserves the balance from your credit card.

First installment

The first installment is charged a few seconds after the purchase authorization or upon shipping.

Pay monthly

Splitit will charge your credit card every month until the plan is finished.

No account setup needed

Splitit works with your existing credit card, utilizing the credit you have already earned, and can be used with any merchant who has Splitit added to their checkout.

After purchasing with Splitit you will get access to your personal online portal where you can manage your plan.

Sample plan

Purchase price of $3,000 split over 6 months using your existing credit card.

| Amount paid | |

|---|---|

| Pay today | $500 |

| 2nd payment | $500 |

| 3rd payment | $500 |

| 4th payment | $500 |

| 5th payment | $500 |

| Final payment | $500 |

Still have questions about how Splitit works?

You can find answers to our most commonly asked questions here. If you can’t find what you’re looking for, please visit our Support centre where you’ll find lots more answers, plus you can live chat with us.

Frequently asked questions

Please visit our support centre.

No, unfortunately not. We are only able to accept credit cards at the present time.

Splitit is supported by Visa, Mastercard, and depending on the merchant, American Express, Discover and UnionPay.

You can find all our terms and conditions here.

Yes.

Splitit helps consumers use their existing credit card to turn purchases into smaller, monthly payments.

The full amount of your purchase is authorized (held) on your credit card to guarantee future payments so you need to have at least that amount in available credit on your card.

The authorization amount reduces with each monthly payment you make until the balance is cleared and we renew these authorizations periodically. The previous authorization is removed as soon as we receive a new one.

Payments are the regualr installments that are charged to your credit card. Authorizations for the full outstanding amount are taken in addition to your regular installments, to guarantee your future payments.

When you buy using Splitit, the retailer takes your first installment straight away, this may be later if your goods are being shipped at a later date. The rest of your monthly installments are automatically taken on the same date as your first one. This date cannot be changed. Monthly installments show as ‘charged’ or ‘posted’ on your account.

In addition to your monthly installment payments, the full outstanding amount is authorized (held) on your card to guarantee future payments. Authorizations are usually renewed every 17-21 days until your plan is paid off. Authorizations get smaller with each installment paid. The previous authorization is released once a new one is obtained. Authorizations show as ‘pending’ or ‘reserved’ on your account. If your plan is kept on track, these authorizations are not charged.

In addition to your monthly installment payments, the full outstanding amount is authorized (held) on your card to guarantee future payments. Authorizations are usually renewed every 17-21 days until your plan is paid off. Authorizations get smaller with each installment paid. The previous authorization is released once a new one is obtained. Authorizations show as ‘pending’ or ‘reserved’ on your account. If your plan is kept on track, these authorizations are not charged.

You can check your monthly payments as well as whether a re-authorization is due (when and for how much), in the Splitit shopper portal.

There are some variations to the above, depending on your retailer and the payment processor they use.

To see exactly how your plan works, log in to the shopper portal and under ‘Plan Details’ click on ‘How Splitit Works?’. This will take you to a detailed explanation of your particular plan.