Installments for education purchases

A responsible BNPL solution ideal for the education sector. Offer installment payments to boost enrolments and reduce new lines of debt for students.

I think 80% of our Splitit transactions are families that we probably would have not enrolled had Splitit not been there.

Maria Aruca – Regional Director, Huntington Learning Center

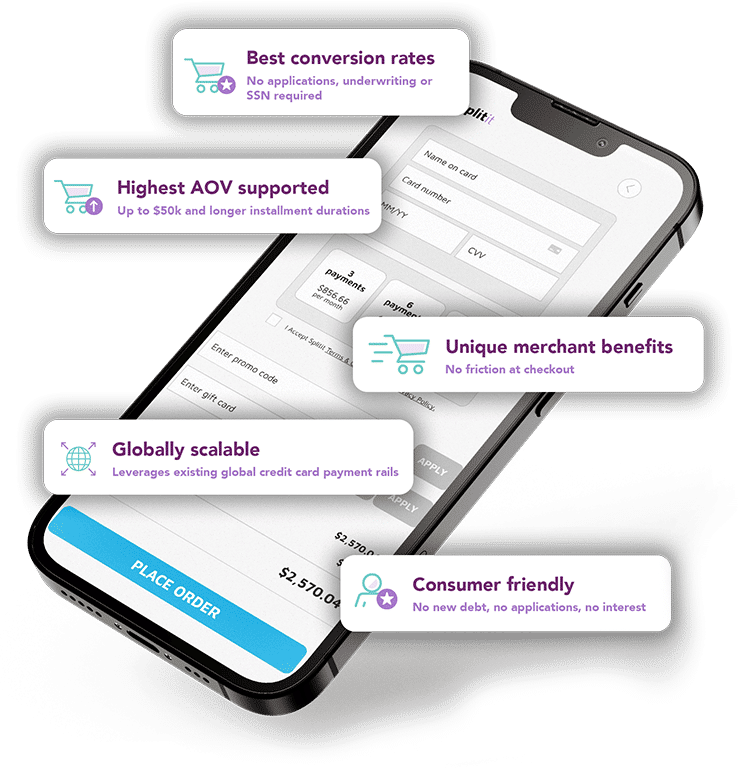

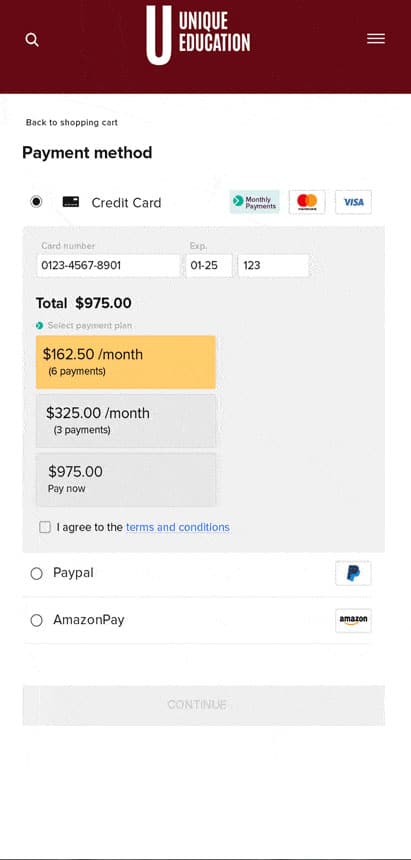

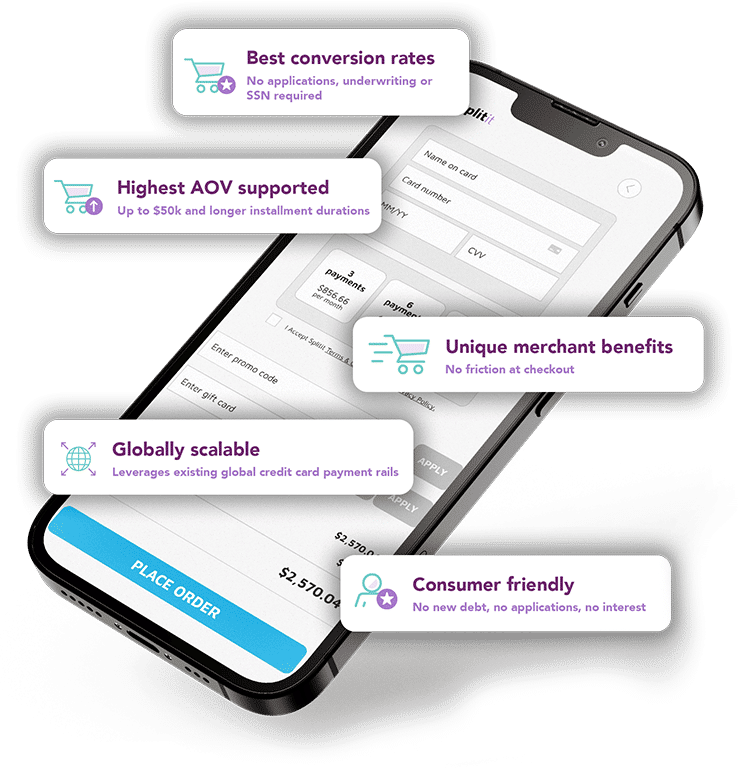

Frictionless payments

Splitit provides the technology that empowers you to offer installment payments embedded within your existing customer journey.

Own the end-to-end journey

Our installment payment solution puts your brand at the centre, allowing you to keep control of your customer journey and increasing your brand loyalty.

No registrations or redirects

Splitit embeds in the current purchase flow allowing any consumer with an active credit card to use the service – there’s no third-party registration or application needed.

Use existing credit

Splitit removes the high risks of legacy BNPL by using existing credit, meaning there is no underwriting and we won’t hurt your shopper’s credit rating.

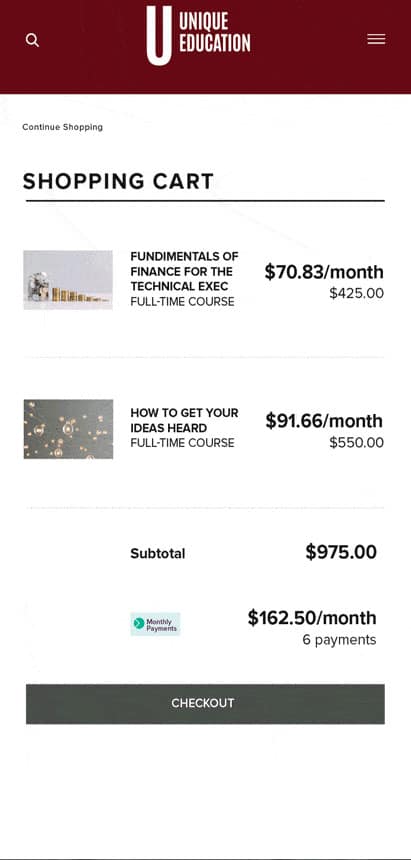

Flexible payment solutions

Splitit offers hassle-free installment payment options, allowing your students’ families to pay tuition over time without the need for credit checks, additional loans, or interest charges.

Enhanced cash flow

Experience improved cash flow with predictable, on-time tuition payments. Say goodbye to late or missed payments and enjoy financial stability.

Higher enrollment rates

Offering flexible payment plans makes your programs more accessible and attractive to a wider range of students, leading to increased enrollment rates.

Zero risk

With Splitit, there’s no financial risk. Your franchise education company can benefit from our service without any cost or obligation, and students’ families won’t incur additional fees.

Security and compliance

Rest easy knowing that Splitit adheres to strict security and compliance standards, ensuring the safety of sensitive payment data.

Personalized support

Our dedicated team is here to support you every step of the way, from onboarding to implementation to ongoing maintenance, providing a level of service that matches your franchise’s commitment to education excellence.

We’ve been able to get students enrolled using Splitit when other payment options weren’t available to the parents. The Splitit system is simple to learn and use.

Rich Bernstein – Owner, Huntington Learning Center

Share a few details and we’ll get in touch

Share a few details and we’ll get in touch