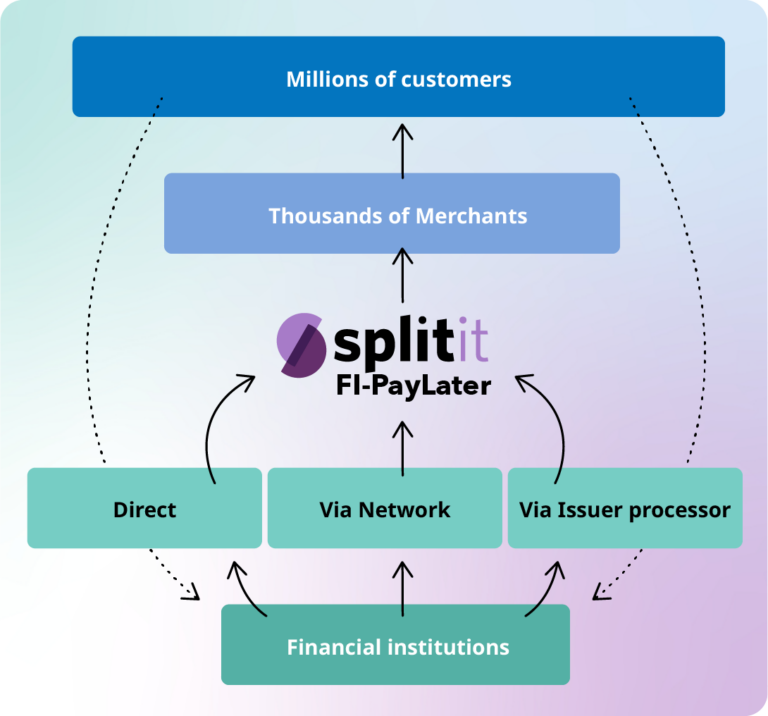

Retain cardholders

Long-Term installment plans that keep cards active and provide a financing alternative for revolvers, preventing “Card Hopping”.

Drive incremental card spend

A better alternative to legacy BNPL where 70-80% of settlements are conducted via debit/direct bank transfer.

Unified API Standard

Our unified merchant-facing API provides a single entry point for multiple installment programs, including eCommerce plugins and POS SDKs, streamlining integration and deployment.

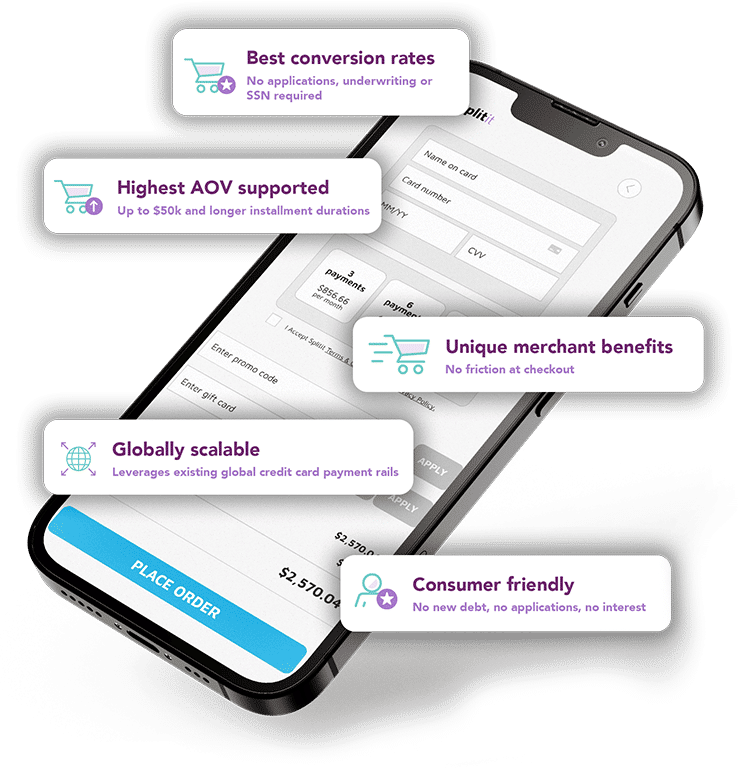

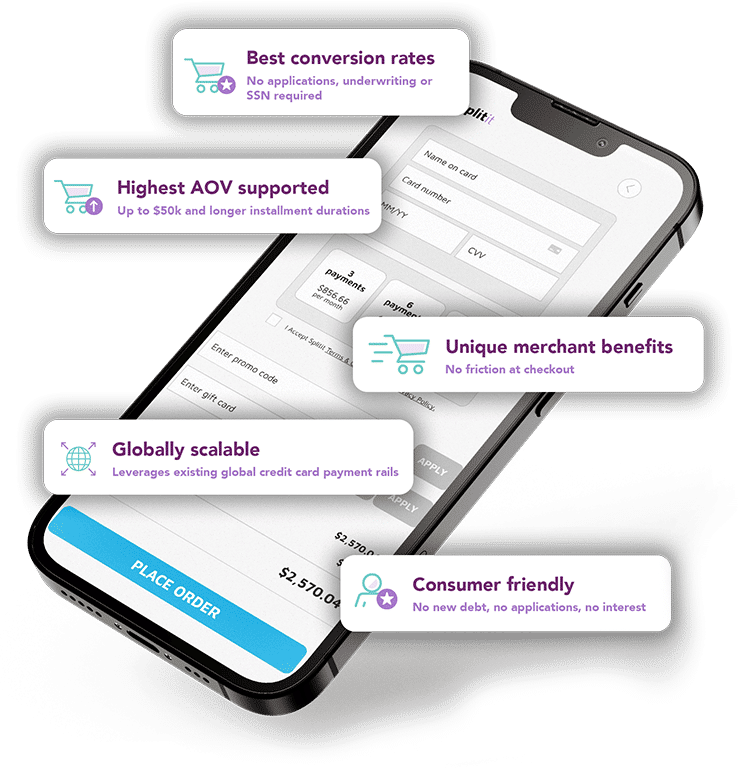

Branded checkout experience

Enhance your brand visibility with an end-to-end checkout experience designed to optimize sales conversion while keeping your brand front and center.

One-click installments

Facilitate easier purchases with one-click installment selection at checkout, complete with customizable preferences for plan duration to suit varying consumer needs.

Flexible funding options

Choose from flexible funding options where either you or Splitit can pre-fund merchants, and collect the installments from the shopper.

A single global API and an extensive network of partnerships makes Splitit’s Installment-as-a-Service the easiest pay-later option to adopt, integrate and operate across all consumer touch points.

Get started with installments

Splitit’s installments-as-a-service solution offers a partnership where technology seamlessly integrates into your operations, allowing you to offer installments at scale without time consuming IT complexities.

Upgrade your existing installments

Splitit can be easily integrated into your existing infrastructure, expanding on your current installments offering.

Share a few details and we’ll get in touch

Share a few details and we’ll get in touch