Platforms

Get the flexibility and control you require to keep your brand front and center with no redirects.

Payment Network Partners

Splitit works with worldwide card network providers including VISA, Mastercard, American Express, Discover Global Network (Discover, Diners Club International and network alliance) and UnionPay.

Payment Service Providers

Whether it’s a reseller opportunity or a simple referral relationship, we have you covered with flexible offerings that will help drive new revenue streams while keeping a keen eye on the bottom line.

Tech providers

Splitit offers multiple avenues to access our Installments-as-a-service platform. We support API based approaches, along with hosted checkout pages that make it easier and faster to launch our customer centric solution.

Independent Software Vendors

Splitit’s integrated payment platform lets you build innovative software solutions that earn more, better monetize payments and retain customers longer.

Independent Sales Organization

Drive revenue by offering a future proof BNPL to your merchants that is integrated into your merchants payment processing partner. Splitit offers eCommerce, integrated and POS solutions that give your merchants the flexibility they need.

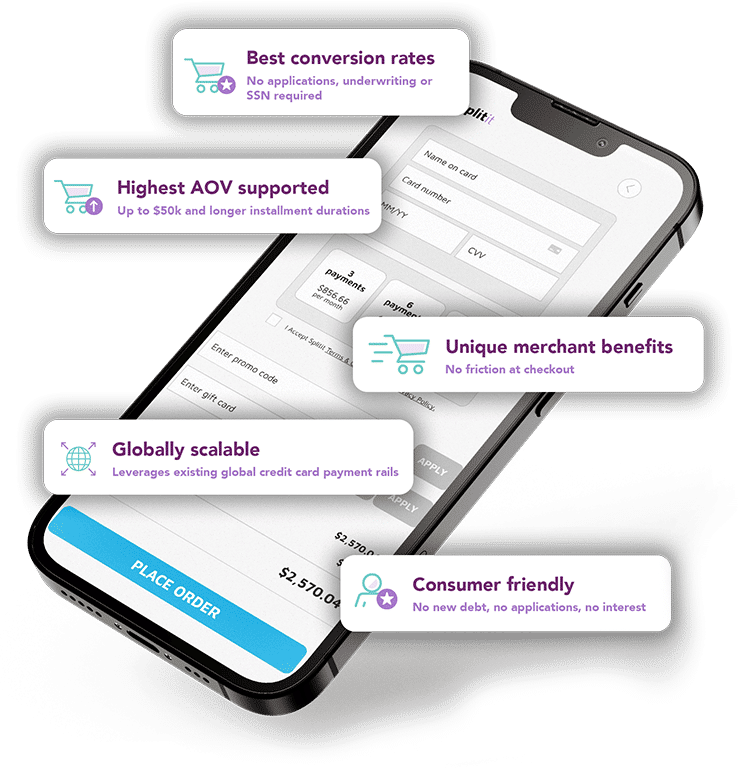

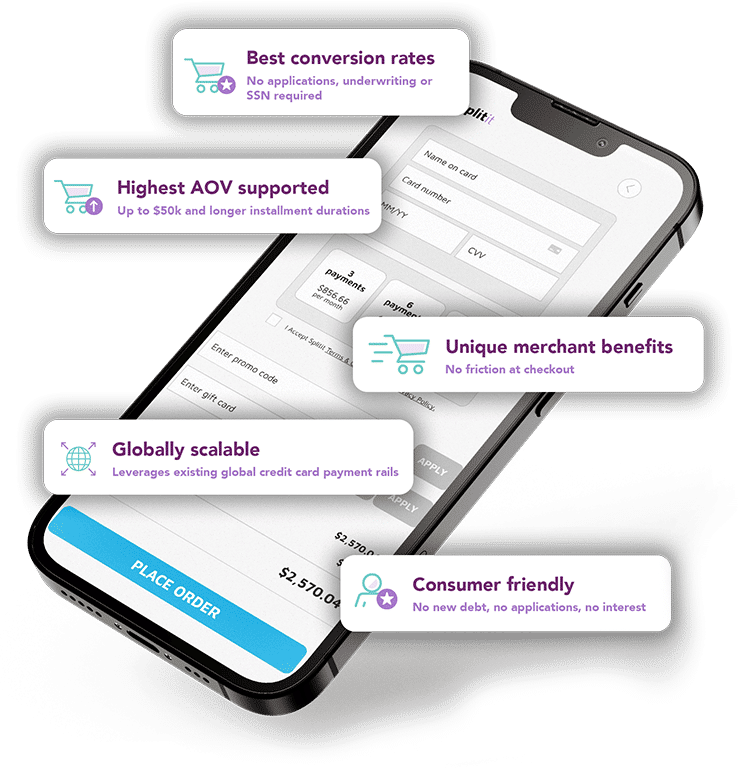

Best conversion rates

Our integrated technology delivers over 85% approval rates, versus an industry norm of 35%-40%. With no applications, underwriting or SSN required, there is no friction at the checkout.

Highest AOV supported

We support order values of up to $50k and offer longer installment durations up to 24 months.

Easy integration

Our single API, white-label BNPL is the easiest installment option for merchants to adopt, integrate and operate while delivering an uncluttered, simplified experience embedded into their existing purchase flow.

Global B2B & B2C services supported

Splitit is able to support B2B and B2C services, globally, unlike legacy BNPL who cannot underwrite businesses for installments. We can scale internationally via the same UX, for both B2C & B2B.

Share a few details and we’ll get in touch

Share a few details and we’ll get in touch