Frictionless payments

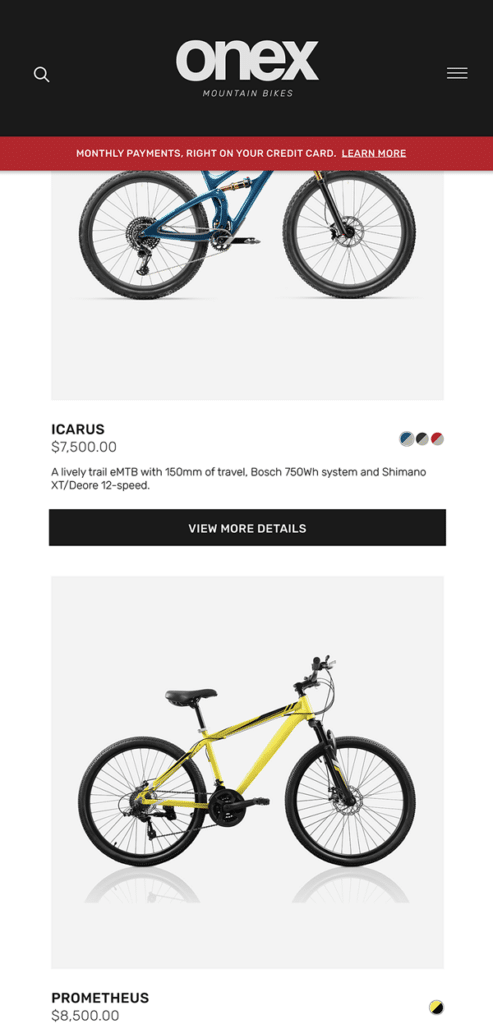

Splitit provides the technology that empowers you to offer installment payments embedded within your existing customer journey.

Own the end-to-end journey

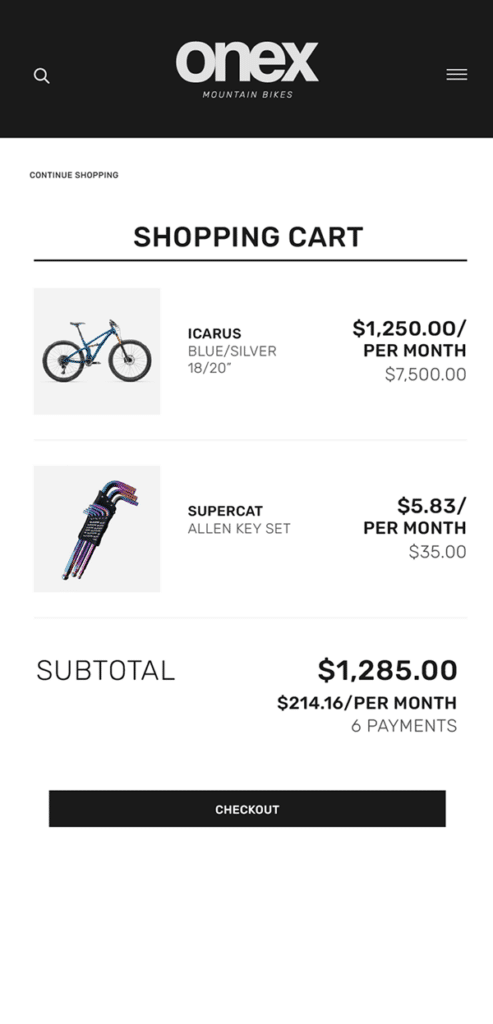

Our installment payment solution puts your brand at the centre, allowing you to keep control of your customer journey and increasing your brand loyalty.

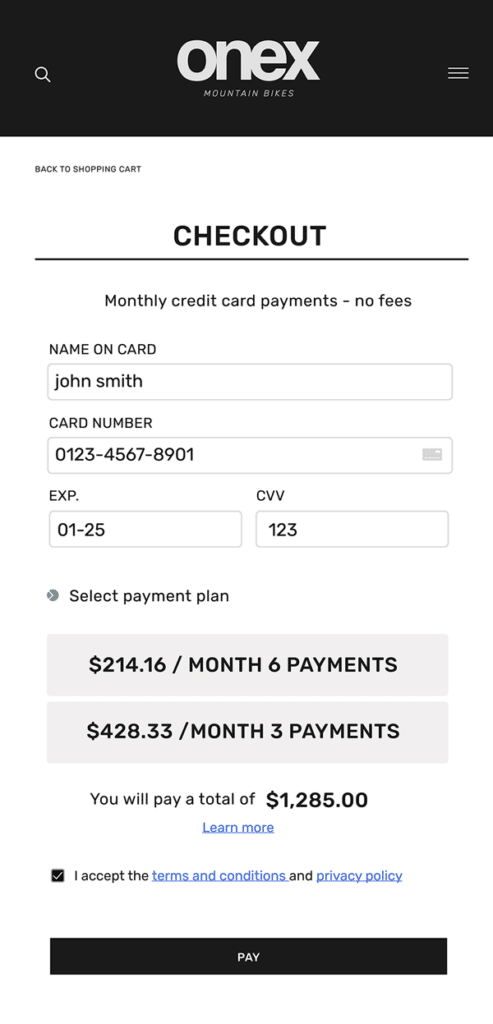

No registrations or redirects

Splitit embeds in the current purchase flow allowing any consumer with an active credit card to use the service – there’s no third-party registration or application needed.

Use existing credit

Splitit removes the high risks of legacy BNPL by using existing credit, meaning there is no underwriting and we won’t hurt your shopper’s credit rating.

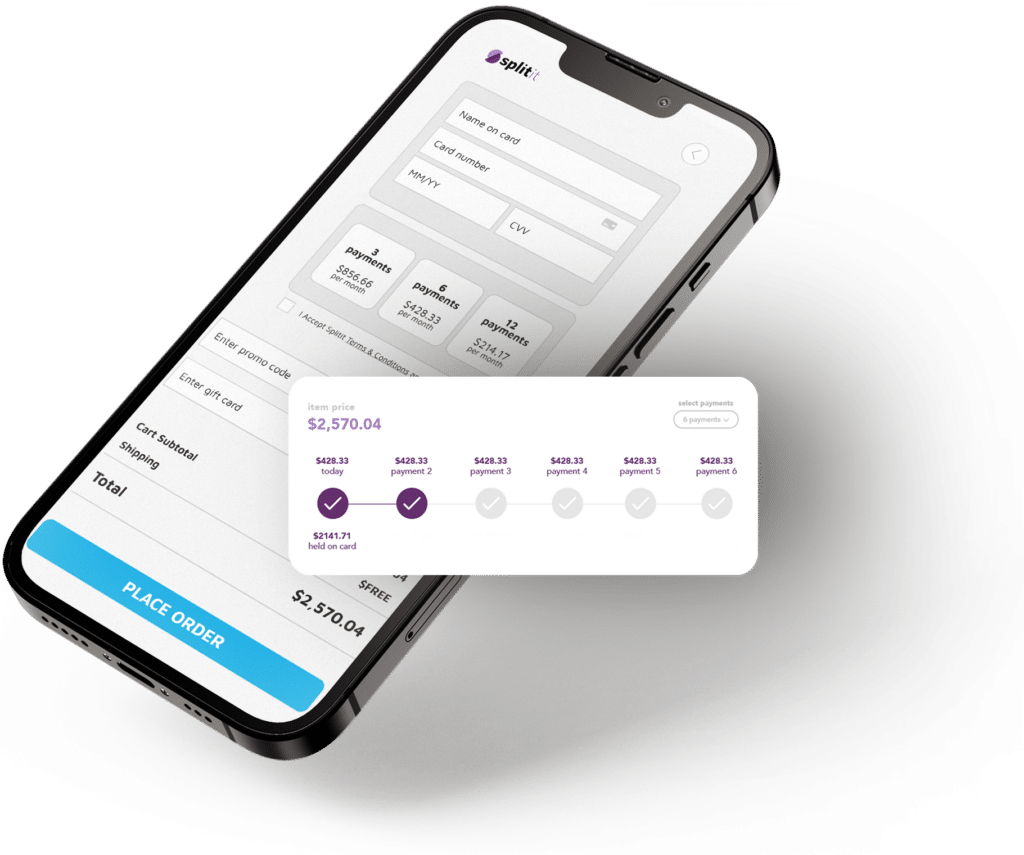

Installment plan

Shoppers can choose to split their payments in monthly installments all within your payment journey.

Authorization

Splitit authorizes the full amount of the purchase on the shopper’s existing credit card and reserves the balance from their credit card.

First installment

The first installment is charged a few seconds after the purchase authorization or upon shipping.

Pay monthly

Splitit will charge the shopper’s credit card every month until the plan is finished.

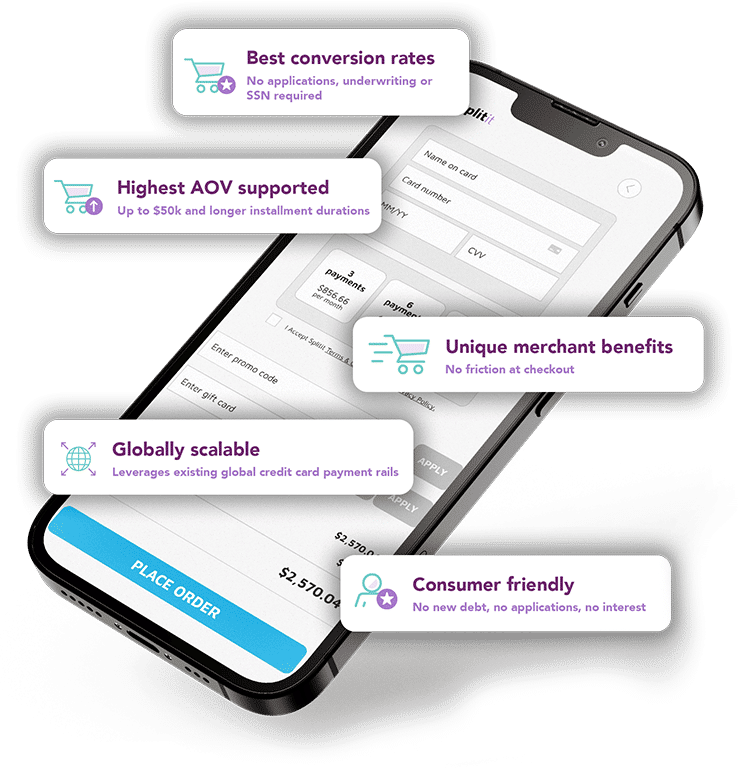

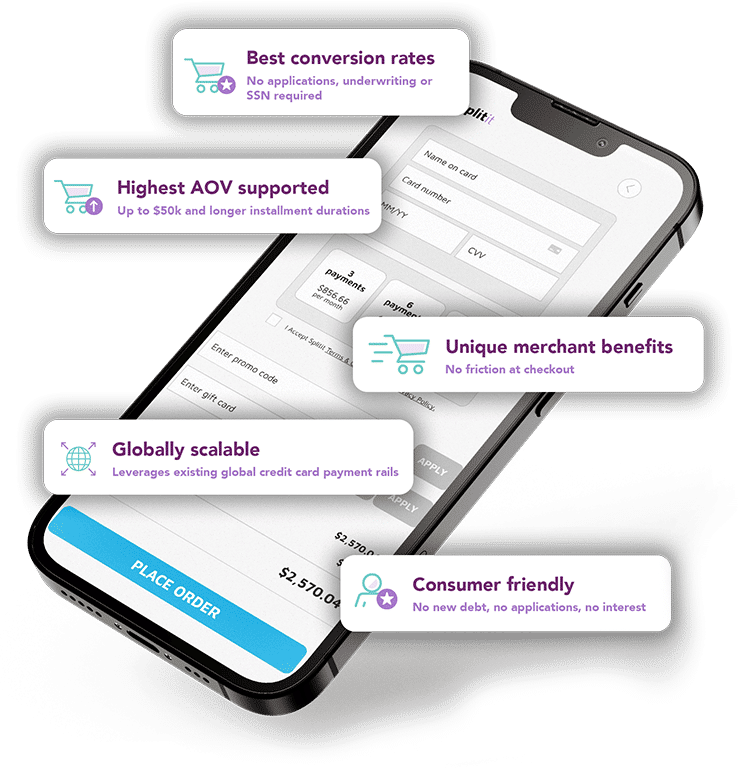

The future-proof pay-later option

Splitit provides the technology that empowers merchants to offer installment payments embedded within their customer journey. We are the only installment payment solution that allows shoppers to use their existing credit card at checkout without increasing their debt.

| Feature | Legacy BNPL | Splitit |

|---|---|---|

| Use Existing Credit | ||

| No Registration | ||

| White-label | ||

| Google Pay/Apple Pay | ||

| At Checkout | ||

| Merchant Integrations | ||

| Industry Agnostic | ||

| No Credit Check | ||

| Low Risk | ||

| Average Order Value | $250 | $1,000+ |

Pay monthly

Give your customers the option to pay in monthly installments.

Pay every two weeks

For added flexibility, we also offer the option for your customers to split the cost of their purchase and make payments in 2 week installments.

Partial installments

Allow your customers to pay a larger sum upfront and split the rest over time.

Pay on delivery

Allow customers to pay when the item is delivered. You can also offer for customers to pay with installments after delivery (just like Cash on Delivery, but digital!).

Share a few details and we’ll get in touch

Share a few details and we’ll get in touch

Frequently asked questions

Installment payments allow customers to spread the cost of a product or service, instead of paying the whole price at once. Depending on the plan they choose, shoppers only pay a percentage of the cost and pay the rest in equal monthly payments over an agreed period.

Installment payments offer customers the flexibility to purchase higher-end, quality products and services but spread the cost over a time that suits them. Offering installment options to your customers increases conversion, along with average order value and builds brand loyalty. With Splitit, there are never any hidden fees or interest rates and customers can also enjoy the usual benefits of using their existing credit card.

Splitit provides the technology to fully integrate into your existing payment platforms, simplifying the journey to purchase. Our services work as a layer between your ecommerce platform and your existing payment gateway. Splitit can be set up easily via a single API integration, which works globally.

Credit checks are not needed to make use of our Installments-as-a-Service solution and it will not affect your customer’s credit score. All a customer needs is their existing credit card and enough available credit to cover the cost of the purchase.