Buy Now, Pay Later (BNPL) has a unique appeal helping fuel its massive growth. However, this growth comes with some troubling side effects for merchants.

As we recently wrote, the growing regulatory scrutiny around the BNPL industry is a positive development for merchants, who have seen their relationships with their customers erode when a BNPL provider harvests their shopper data.

Data harvesting is more than just a privacy or security issue. These apps drive a wedge between merchants and their customers, negatively impacting loyalty and the overall customer lifetime value (LTV) of the relationship.

The data divide

Legacy BNPL lenders have done an excellent job of enticing shoppers with super apps that become a honey pot for product discovery, discounts and purchases – all thanks to the data they’re gleaning from their merchant customers.

Merchants spend resources to bring customers to their sites and turn to BNPL with the expectation of driving new sales and increasing consumer loyalty. Shoppers get to pay over time and the merchant gets the conversion, but the BNPL lender now has valuable data on your shoppers. The overall return on investment rarely favors the merchant.

The BNPL lender uses this data to accelerate their business growth at the merchant’s expense. Instead of the merchant reaping the loyalty reward from their hard-earned marketing dollars, the BNPL monetizes the newly acquired customer. In essence, the customer becomes the BNPL’s product.

Decrease in loyalty and customer lifetime value

The appeal of discounts and discovery is a winning combination that has propelled many other consumer trends. Remember Groupon? E-Bates? All great examples of companies built on this formula. BNPL is no different, bombarding shoppers with thousands of new offers. Although this sounds like a winning hand for merchants, this decreases their customer loyalty and overall customer lifetime value.

Why? Now more than ever, first-party data is increasingly more valuable. Rising customer acquisition costs (CAC) are straining e-commerce profitability, putting more pressure on driving repeat sales where existing customers spend 67% more on average than those new to your business.

Shifting the business mindset from a transactional model of bringing in new customers to one that favors long-term value is critical in today’s economic environment. A one-sided approach will yield a low LTV to CAC ratio, where you lose money on each transaction.

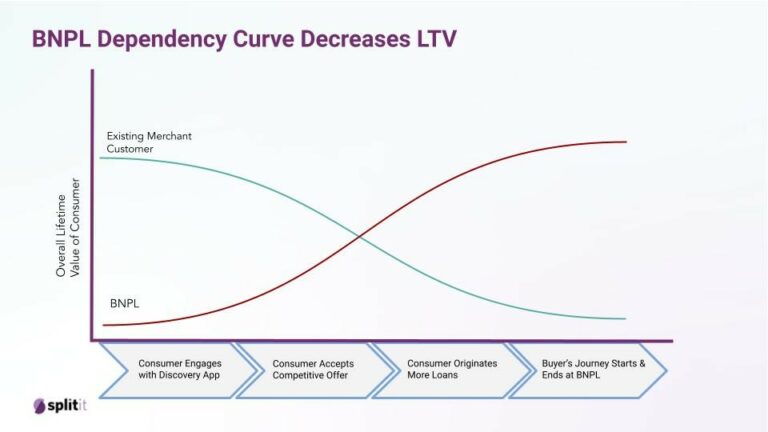

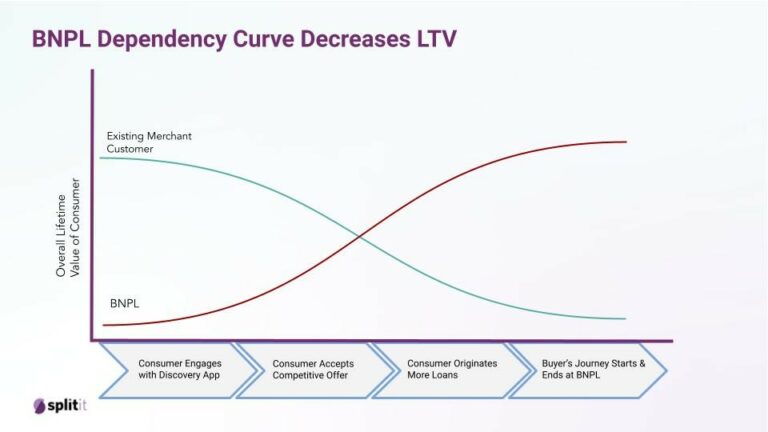

The dependency curve above illustrates how BNPL data harvesting impacts loyalty and overall LTV for a merchant’s existing customer base. In the beginning, the overall LTV of an existing and loyal customer favors the merchant. However, The more the customer engages with the BNPL super-app, the balance begins to shift in favor of the BNPL.

While it is questionable to willingly route a loyal shopper to a third-party whose objective is to capture data for their own gain. It sounds like madness when you factor in the lost loyalty and LTV to the merchant.

Protecting Your Investment Long Term

What can you do to protect your investment? It starts by protecting your customers’ data and the integrity of the relationship. Keeping end-to-end control of your customer journey preserves your customer acquisition investment while increasing loyalty and LTV.

Are we saying ditch BNPL altogether? No, because not all BNPL providers are created equal. There are plenty of beneficial options for you to choose from that can help your business grow. However, there are some best practices to consider when selecting a BNPL partner:

- Protect Your Brand: Look for a white-label service that promotes your brand, not the brand of a third party. Ideally, a solution that embeds into your existing consumer journey without creating an out-of-brand experience.

- Protect Your Customer: Ensure that the BNPL is not hijacking the direct relationship between you and your customer. Ask questions about what data they are gaining from each transaction. Protect your business from a partner that makes money from reselling your customers’ data.

- Target Growth Consumers: Look for a partner that drives long-term loyalty and repeat purchases, not just a quick sale. In an environment with escalating inflation where originating new loans will become harder, you need a partner that can target consumers with existing available credit and a propensity to spend more.

Splitit, for example, gives merchants full control over the entire shopper experience including their customers’ data, allowing them to nurture and keep their customers, driving loyalty and promoting brand consistency on their terms.

The chart above illustrates how Splitit augments and supports CAC investments and the LTV of shoppers. Splitit’s white-label approach, embedded in the existing customer journey, ensures brand consistency while driving loyalty and repeat purchases.

Want to hear more? As always, we’re here to talk!