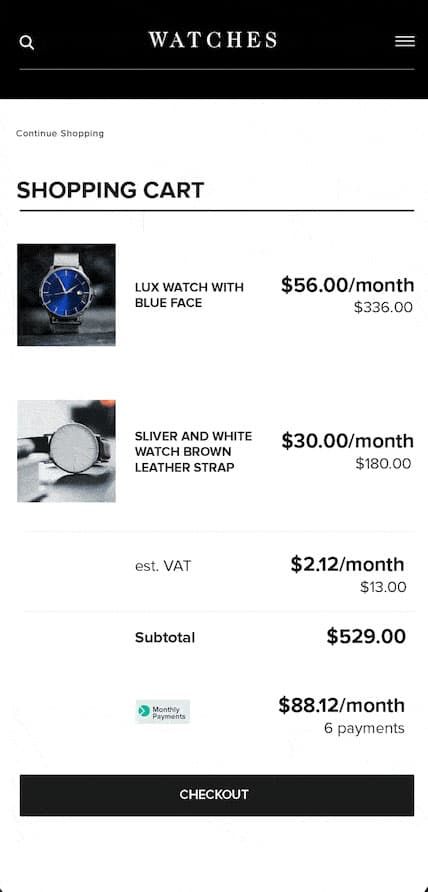

Installments for Luxury purchases

A BNPL solution designed for big-ticket, luxury purchases, offer a more responsible way for shoppers to pay in installments.

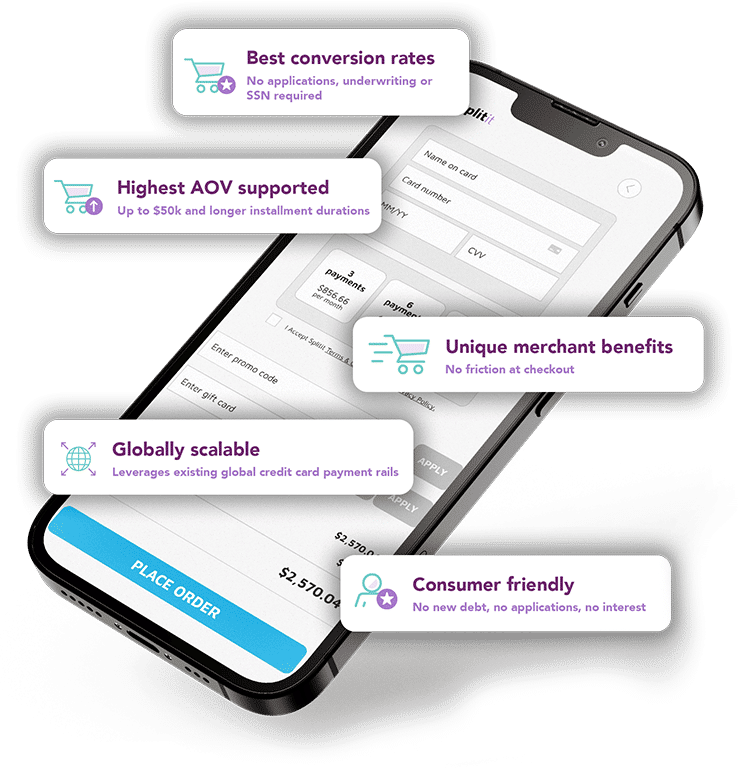

Frictionless payments

Splitit provides the technology that empowers you to offer installment payments embedded within your existing customer journey.

Own the end-to-end journey

Our installment payment solution puts your brand at the centre, allowing you to keep control of your customer journey and increasing your brand loyalty.

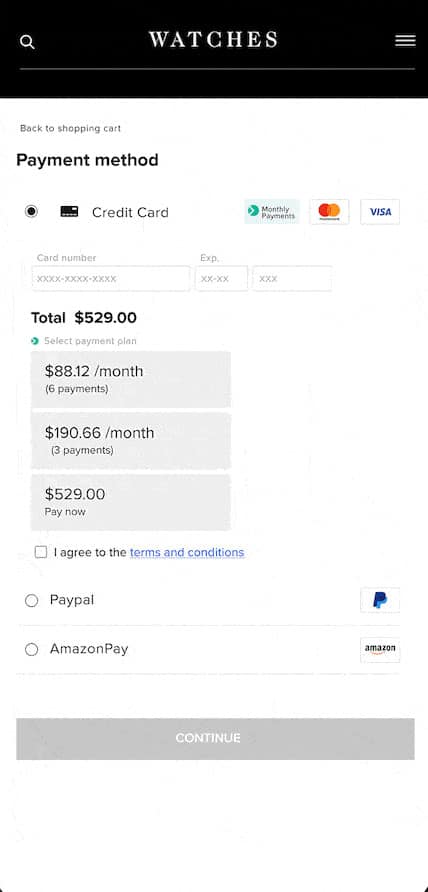

No registrations or redirects

Splitit embeds in the current purchase flow allowing any consumer with an active credit card to use the service – there’s no third-party registration or application needed.

Use existing credit

Splitit removes the high risks of legacy BNPL by using existing credit, meaning there is no underwriting and we won’t hurt your shopper’s credit rating.

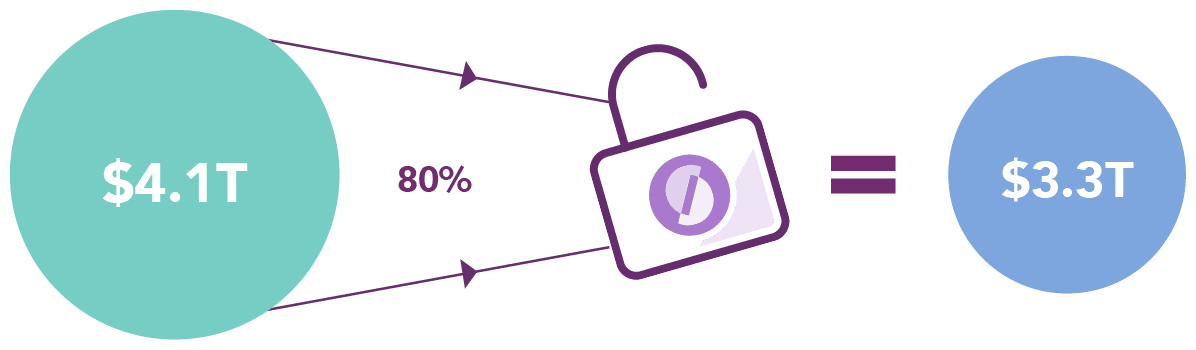

Increase transaction values

With Splitit’s card-attached installments there’s no arbitrary purchase limit, customers can maximize their purchasing potential using their existing available credit, leading to higher transaction values.

Drive more conversions

Our integrated technology delivers over 85% approval rates, versus an industry norm of 35%-40%. With no applications, underwriting or SSN required, there is no friction at the checkout.

Zero default risk

Splitit operates with customers’ existing credit cards – their installment payment plan lives within the limits of their existing credit card. This means there’s no risk of defaulting on payment – should a customer miss their payments, the total order amount will be charged to their card.

Get our self-guided demo

Explore the advantages of Splitit in your own time, no meeting necessary.

Submitting your email here signs you up for nothing more than the demo you asked for. We respect your privacy and the trust you place in us by sharing your details.