View success story

View success story

Flexible payment solutions for home and furniture stores

Offer responsible installment payments perfect for furniture and other big-ticket purchases. Splitit’s card-linked solution helps furniture retailers increase sales while giving shoppers the flexibility they need—both in-store and online.

Furniture financing that puts your customers first

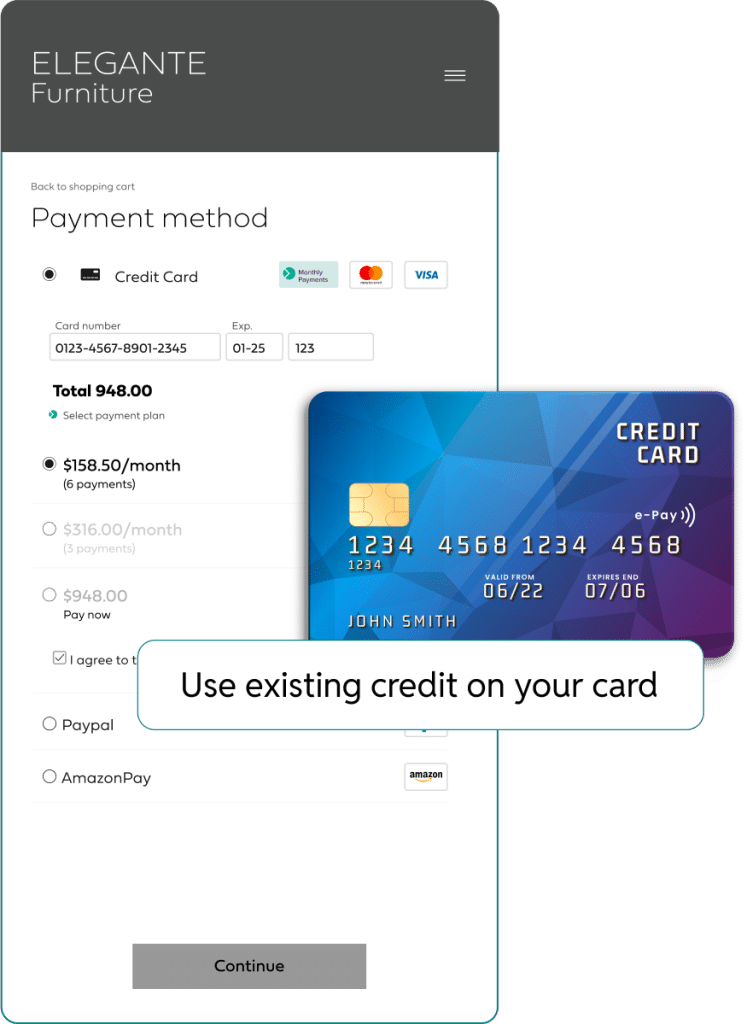

Traditional furniture store financing often creates new debt for shoppers. Splitit offers a more responsible alternative—we’re the only installment payment solution that allows customers to use their existing credit card at checkout without taking out new loans or increasing their debt burden.

With regulations tightening around legacy BNPL providers, furniture retailers need a future-proof solution. Splitit operates under existing credit card regulations, protecting your business from regulatory uncertainty while offering the flexible furniture payment options your customers want.

Frictionless furniture store payment plans

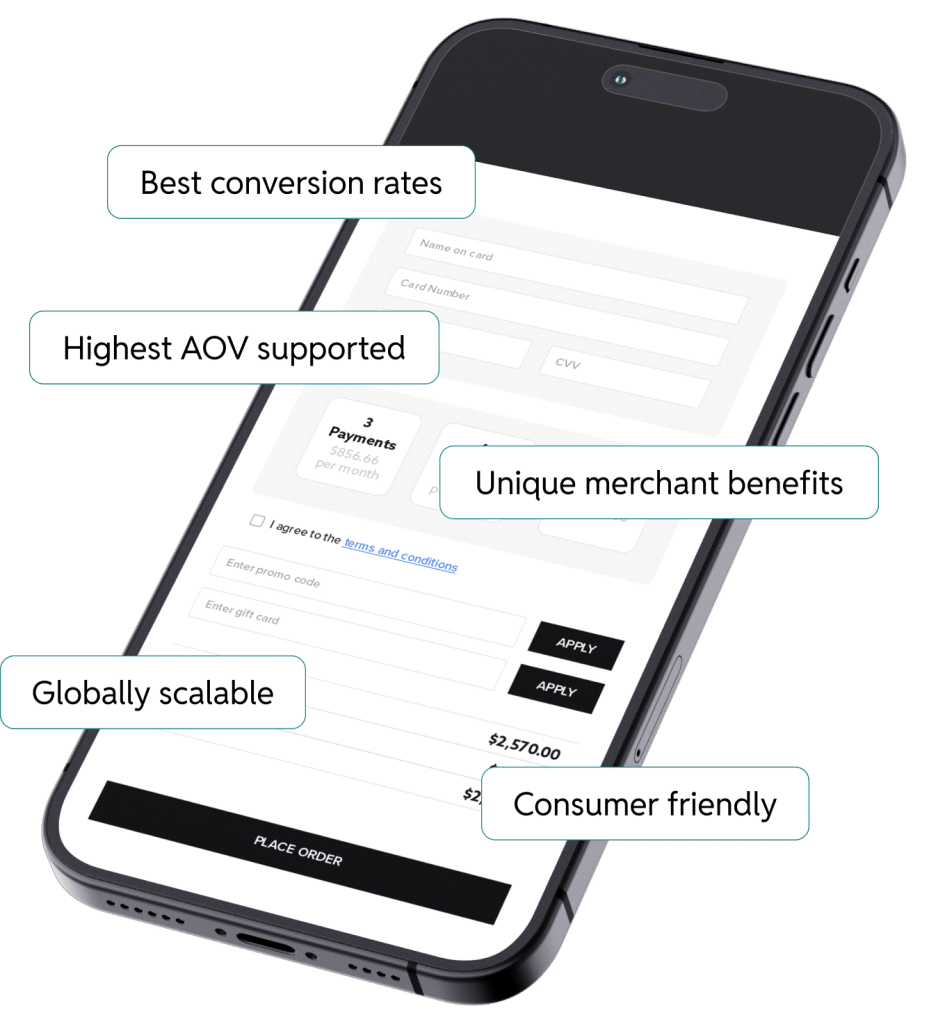

Splitit provides the technology that empowers you to offer installment payments embedded directly within your existing customer journey. Our white-label solution means your brand stays front and center throughout the entire checkout experience, with no third-party logos and no redirects. Just smooth furniture payment options that feel like a natural part of your store.

Complete control over your customer experience

Splitit places your brand at the heart of every transaction, ensuring that you maintain complete control over the customer experience.

By managing the entire journey, you can tailor the shopping experience to reflect your furniture store’s unique values and drive repeat business.

Leverage existing credit for higher approval rates

Splitit removes the high risks of legacy BNPL by using existing credit, meaning there is no underwriting and we won’t hurt your shopper’s credit rating.

For furniture retailers, this means fewer lost sales at checkout and more completed transactions. Plus, shoppers get all the benefits of paying with their credit card, including rewards points, transaction insurance, and protection against fraud. It’s a win-win that makes furniture financing accessible to more customers.

No registrations or redirects

Splitit embeds into your current purchase flow, allowing any consumer with an active credit card to use the service – there’s no registration or application needed.

Our seamless integration keeps the checkout smooth and straightforward, eliminating the friction that causes cart abandonment. The result? Higher conversion rates and a checkout experience that’s quick, easy, and secure for furniture shoppers making significant purchases.

Increase furniture sales with flexible payment plans

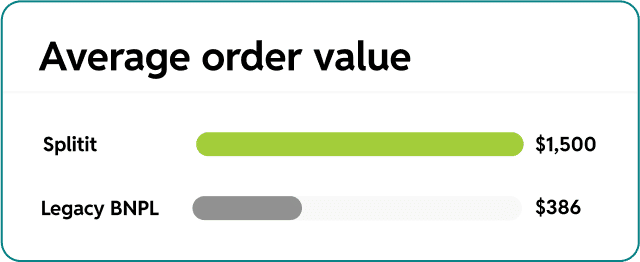

Furniture stores using Splitit see significantly higher average order values compared to traditional payment methods. With card-linked installments, there’s no arbitrary purchase limit imposed by a third-party lender. Instead, customers can maximize their purchasing potential using their existing available credit.

This enables customers to upgrade to premium furniture pieces, add complementary items, or complete entire room sets they might otherwise defer. This flexibility leads to higher transaction values and increased revenue per customer.

Drive more conversions with furniture payment options

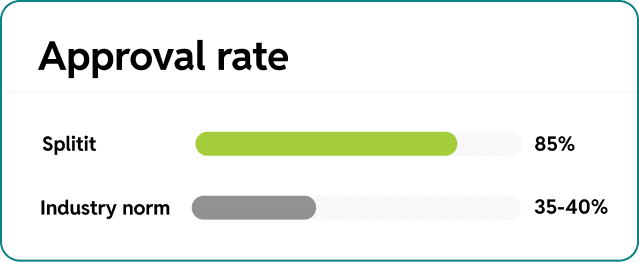

Our integrated technology delivers over 85% approval rates, versus an industry norm of 35%-40%.. Traditional financing options create multiple points of friction: lengthy applications, credit checks, waiting for approval decisions, and potential rejections. Splitit eliminates these barriers entirely.

Omnichannel payment experiences for furniture retailers

Today’s furniture shoppers move fluidly between online and in-store — comparing styles online, visiting showrooms, and completing purchases wherever it’s most convenient.

Our card-linked installments work seamlessly across every channel, giving customers the same simple, responsible payment experience whether they’re shopping online, in your showroom, or through your sales team.

With Splitit, there are no separate applications or finance systems to manage. Your brand stays front and center across every touchpoint, while customers enjoy one consistent payment option that fits naturally into their buying journey.

By unifying your online and in-store payment experience, you can:

- Reduce friction and abandoned carts across all sales channels

- Deliver a consistent brand experience that builds trust and repeat business

Latest insights for home and furniture retailers

Practical insights to help you expand access, win more high-value sales, and strengthen relationships with your customers.

Cart Abandonment at Checkout: Why Furniture Merchants Lose High-Value Sales

Read more

Black Friday Payment Solutions: Why Payment Flexibility Matters Most During Peak Shopping

4 min read Read more

The Samsung Wallet Revolution: Your In-Store Sales Just Got a Major Upgrade

Read more

Splitit vs Klarna: a complete BNPL comparison for businesses

Read more

New Study reveals a strong preference for pay-later options during the holiday season

5 min read Read moreReady to add comfort to your payment solutions?

See how Splitit can bring flexibility to your furniture business while increasing sales and customer satisfaction. Reach out for a friendly, no-obligations chat about how card-linked installments can work for your store.

Frequently Asked Questions

Unlike traditional furniture store financing or BNPL providers, Splitit uses customers’ existing credit cards rather than originating new loans. This means no credit checks, no impact to credit scores, 85%+ approval rates, and no regulatory risk for merchants.

Splitit offers both funded and unfunded models. With the funded option, you receive the full payment upfront (minus fees) while customers pay over time—Splitit assumes all payment risk. This actually improves cash flow compared to in-house financing arrangements, where you wait months for full payment.

Absolutely. Splitit is ideal for big-ticket furniture purchases because there’s no arbitrary purchase limit. This makes Splitit perfect for premium furniture, complete room packages, luxury pieces, and whole-home furnishing projects that traditional BNPL providers can’t accommodate.

When a return is processed, the installment plan is adjusted or canceled accordingly, and any relevant refunds are processed back to the customer’s credit card. The process is straightforward and aligns with standard credit card refund procedures.